PlanB recently stated in an interview that his stock-to-flow model has not yet been proven false and that Bitcoin may be headed for a significant rally.

If we assume the old model, the original 2019 model is correct, the $55,000 model, then the next halving could lead to prices somewhere between $100,000 and $1 million. He is predicting a very wide range, which some people are not in favor of.

PlanB has even gone so far as to claim that he is confident the prediction will hold up until either his model is totally disproven or “Bitcoin dies.”

According to Plan B no matter how you look at it, the current price is a bargain if you believe BTC will eventually reach that $100,000–$1 million range.

In the short term, PlanB predicted that over the coming months, Bitcoin would most likely reach the bottom of the current bear market.

The stock-to-flow model is a type of quantitative economic model that bases the price of goods on the total amount of supply already in existence (stock) and the new supply created over a specific period of time (flow). In the case of Bitcoin, the stock represents the existing supply, and the flow represents the newly-mined Bitcoin.

Bitcoin halving are planned occasions that reduce the mining rewards for each new block by 50%, cutting the rate at which new bitcoins are created in half. The price prediction made by this model will significantly be impacted by halving. We can see how well the model has predicted Bitcoin’s performance by looking at the 463-day version of the model, which “smooths out” the price increases following halving by averaging out.

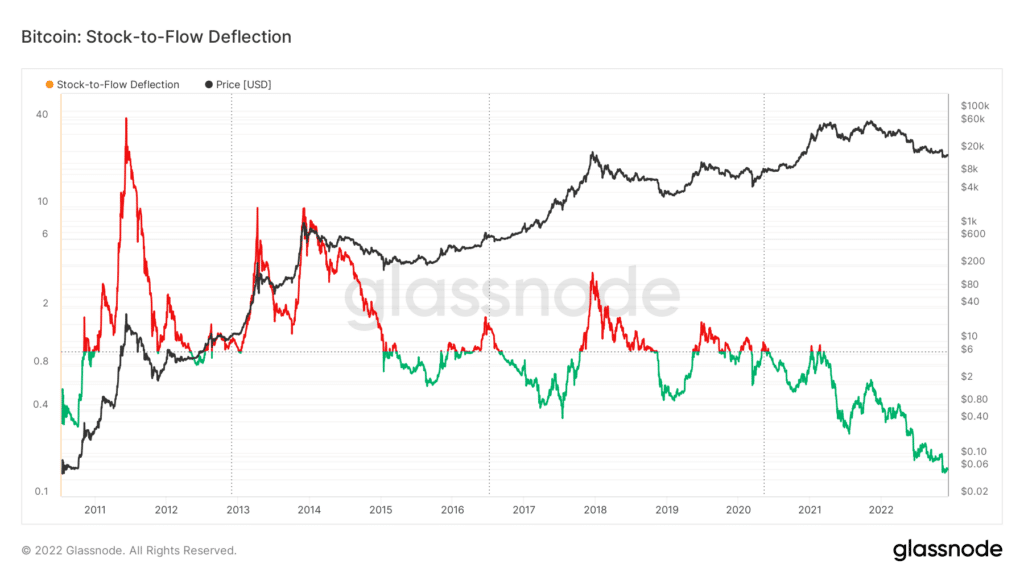

The most recent bear market, according to many, rendered the Bitcoin stock-to-flow invalid. Others claimed that the coin’s price had deviated from the model’s forecast further than ever. However, it is clear from the stock-to-flow deflection chart on the blockchain data service Glassnode that the latter claim is untrue.

The graph unequivocally demonstrates that Bitcoin’s current value is less than 15.3% of what the stock-to-flow model predicts it should be. However, the price was worth nearly 40 times more during the bull market of 2011 than the model predicted. Before, the price deviated much more from the S2F estimates than it does now, but it never deviated below zero.