Google (or DDG) “inflation” and you’ll find articles with headlines like “US Inflation Jumps to Fresh 4-Decade High of 8.5 Percent in March” from nearly every media outlet. That is a large number. When investors become concerned about inflation, they take a “risk-off” approach and pile into inflation hedges and store-of-value assets such as gold and… bitcoin?

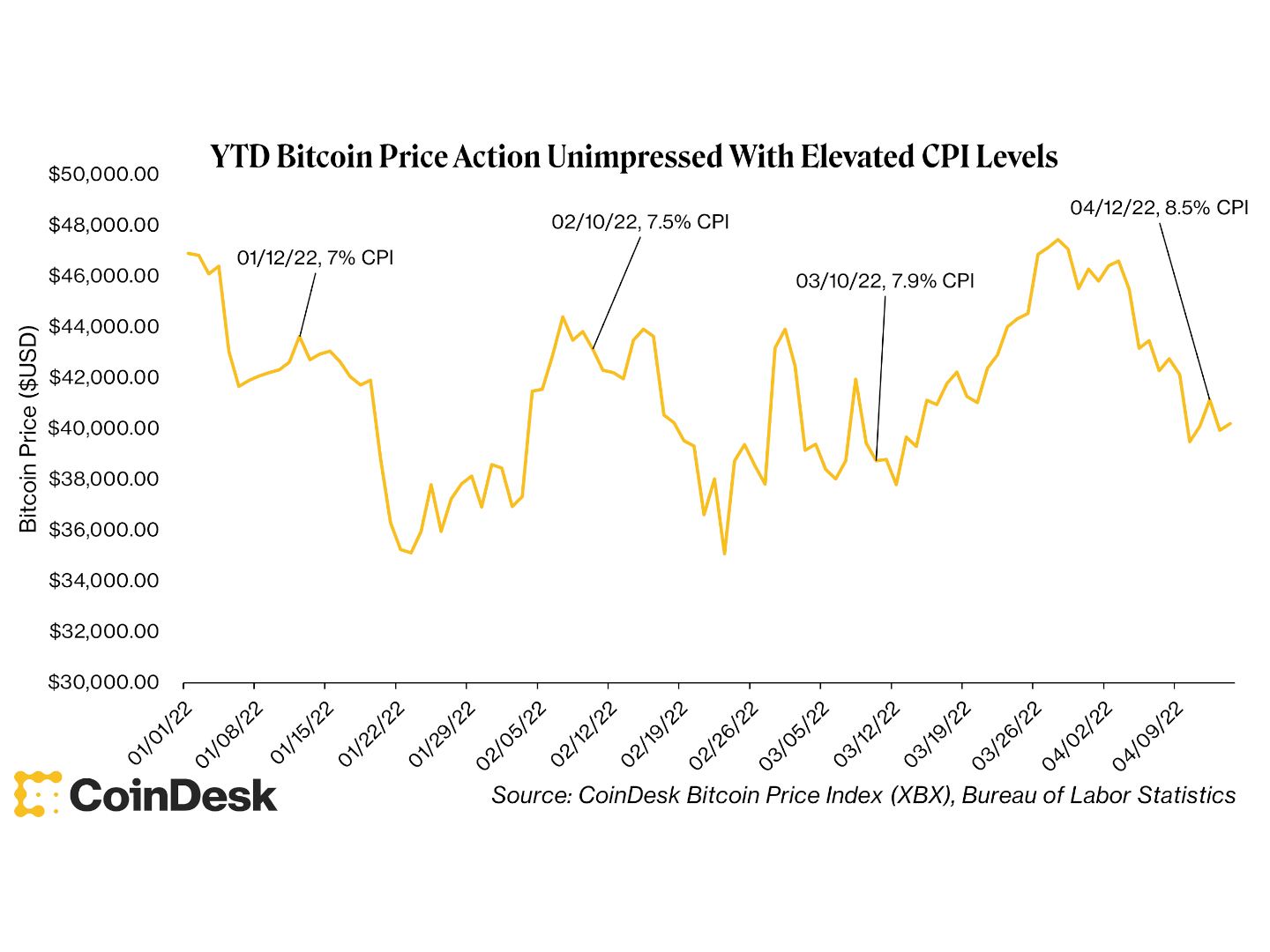

So, why didn’t bitcoin’s price skyrocket after the inflation print was released last week? Is bitcoin an ineffective inflation hedge? Is it ever going to be a valuable store? Despite its allure, Bitcoin’s sound money characteristics should predispose it to being a useful inflation hedge and store of value. That hasn’t worked. So, what’s the deal? How lofty is the “bitcoin as a store of value” narrative? Are bitcoin investors out of luck? Why is bitcoin behaving like a technology stock?

The dominant economic theory is based on three pillars: output, money, and expectations. People and groups in charge of economies want to boost economic output and strengthen their sovereign currency against other currencies, while also managing future expectations in order to avoid economic downturns. There isn’t enough space in a column to go into the nitty-gritty of all of these concepts, so let’s focus on money, expectations, and the entity in charge of those two in the United States, the Federal Reserve, and how they relate to recent inflation woes (and Bitcoin!).

The Fed is in charge of monetary policy in the United States, intending to ensure “maximum employment, stable prices, and moderate long-term interest rates.” To achieve its goal, the Fed can use three levers: 1) open market operations (also known as “print money”), 2) the discount rate (also known as “interest rates”), and 3) reserve requirements (also known as “vault deposit rules”). The main mechanisms we’ve seen the Fed employ in recent memory are printing money (by purchasing bonds and “stuff”) and changing interest rates (by changing the rate it charges banks to lend money overnight).

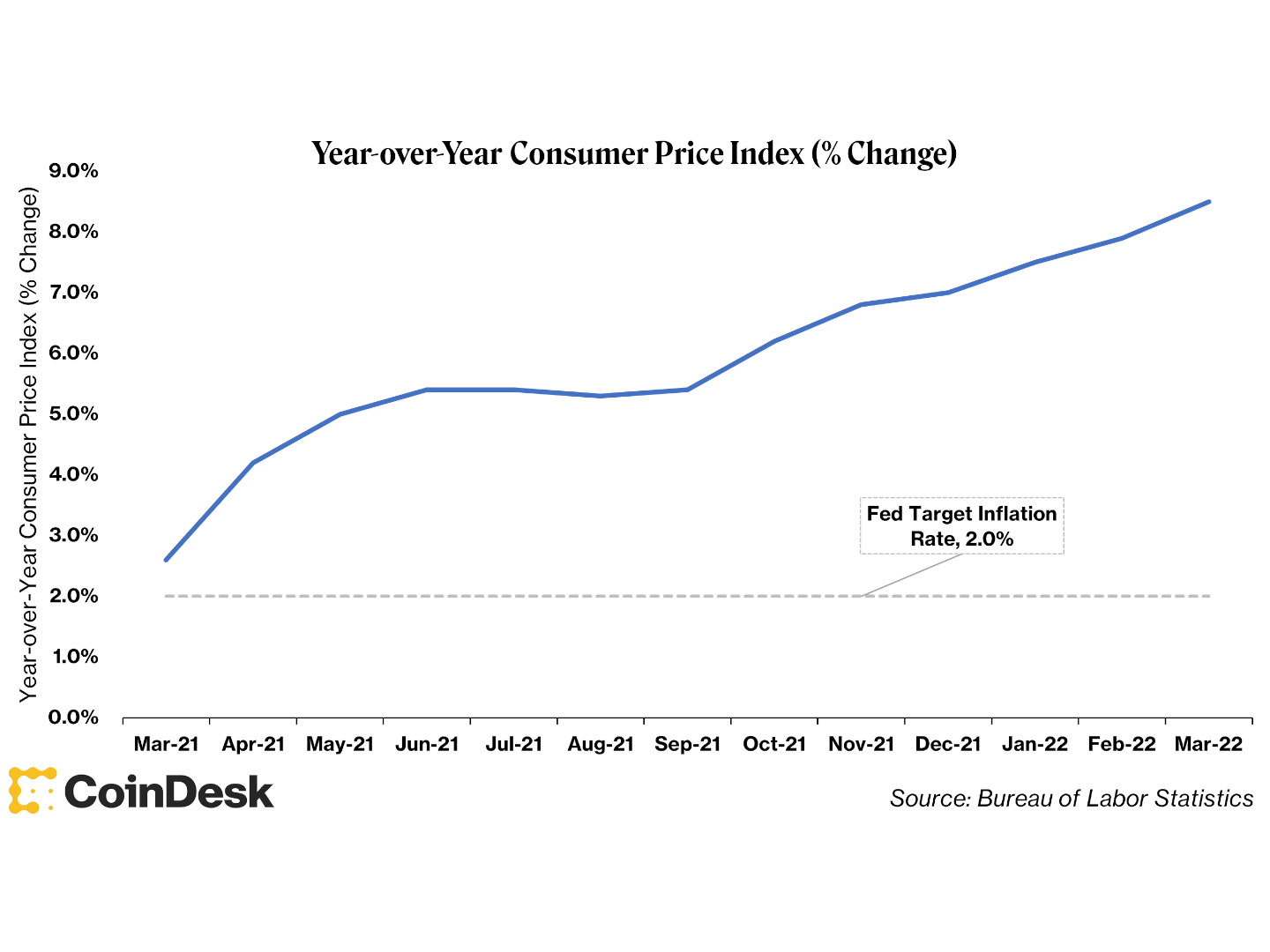

The Fed’s goal is “stable prices,” which has historically meant an arbitrary 2% target for inflation each year, which means the Fed wants things to cost 2% more each year. In March, the consumer price index, which measures inflation, reached a four-decade high of 8.5 percent year on year. Essentially, last year’s $10 burrito has increased to $10.85. That’s not a good sign. Furthermore, year-over-year CPI metrics have exceeded 2% every month since March 2021. Inflation is not a fad.

I’m not going to go into detail about how unprecedented money printing and near-zero interest rates got us here. Instead, I’ll discuss what investors are doing to protect their portfolios.

In times of high inflation and economic uncertainty, investors take a risk-averse approach, resulting in a “flight to quality.” In practice, when sentiment turns risk-off, investors sell their risky tech stocks and buy bonds, or, if they are truly concerned about inflation.

And do you know what’s more valuable than gold? Of course, it’s Gold 2.0. Bitcoin (or the Reserve Asset 3.0). Because we have high inflation, everyone piled into bitcoin, and its price skyrocketed, right? Not quite…

What’s going on? Isn’t this good money? Isn’t this a value store with a known current supply and emission schedule? Isn’t bitcoin demonstrably scarce? I thought bitcoin’s emission schedule didn’t change as demand for the asset increased?

All of this is correct: Bitcoin has a known monetary policy with a hard cap and a predetermined minting schedule; anyone with a full node (a basic computer with some software) can tell you how many bitcoins are in circulation; and if the price of bitcoin rose to $1 million tomorrow, the coins would not be mined any faster than they are today.

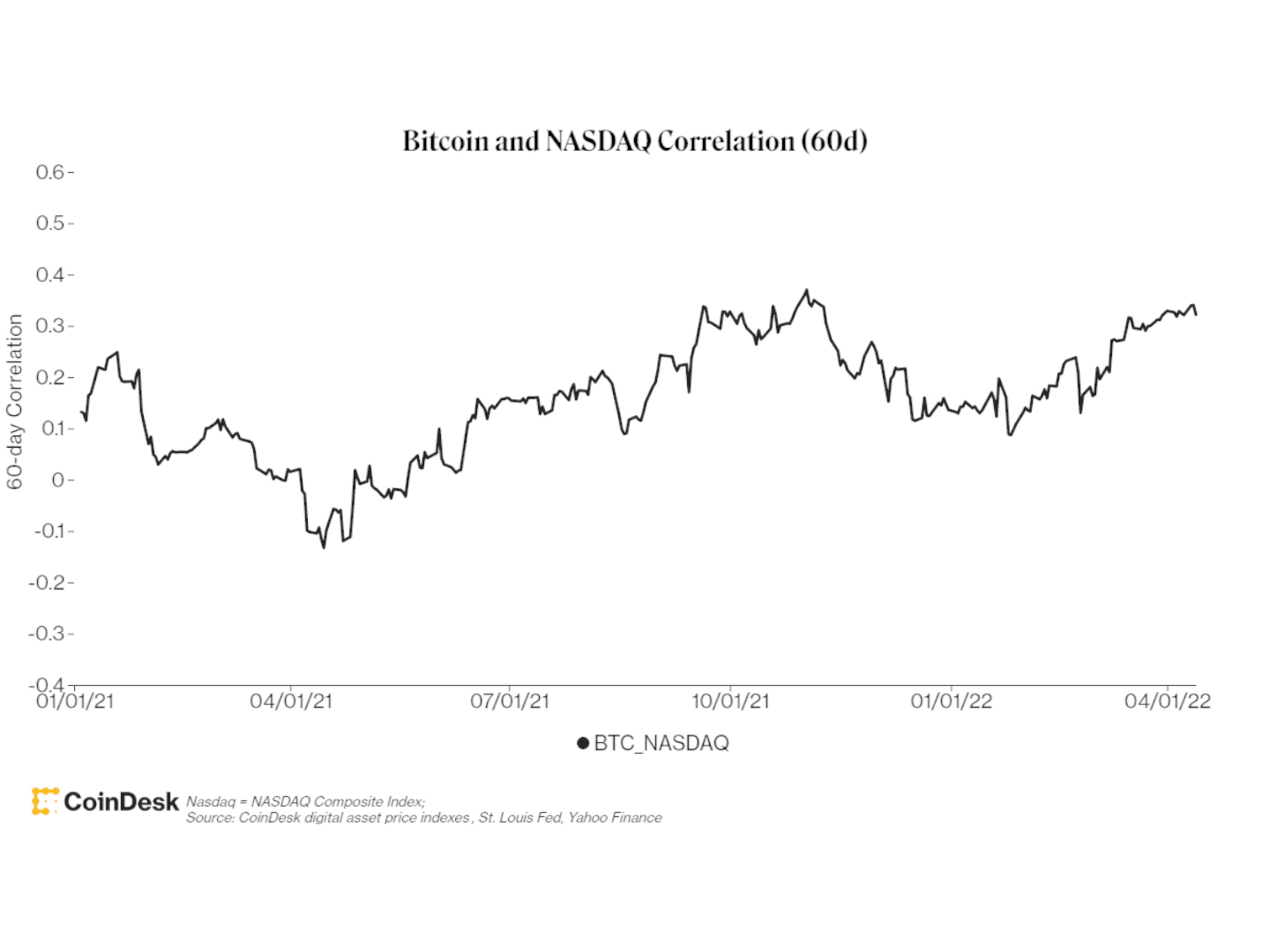

On a 60-day basis, bitcoin’s price has been somewhat correlated (> 0.20 correlation coefficient) with Nasdaq technology stocks for roughly half of the trading days in 2022. That, I believe, is due to a simple reason. While bitcoin supporters see it as a risk-off asset due to its hard money properties, investors see it as a risk-on asset due to its volatility and technology-like asymmetric price upside. When investors want to reduce their risk, they sell stocks in addition to bitcoin. As a result, bitcoin is not yet a risk-off or risk-on asset. Instead, I believe it is more appropriate to call it “risk everything.”

As a result, referring to bitcoin as an aspirational store of value is probably more accurate. Yes, a borderless, permissionless, uncensorable, sound monetary system-of-value transfer with predictable monetary policy is theoretically a great store of value, but until that narrative reaches more than 100 million people, the other 7.8 billion people will not see it as a store of value, and that narrative will prevail for the time being.