The regulatory journey of cryptocurrencies (cryptos) in India has seen several ups and downs, paralleling the steep highs and lows of the open market price of these cryptos. The Union Government’s stance on digital assets has shifted dramatically in recent years, from an outright ban to a Bill for regulation.

The Union Budget 2022, for example, includes a 30% tax on income from cryptos and other digital assets with no offset and a 1% TDS, which is discouraging to the crypto community.

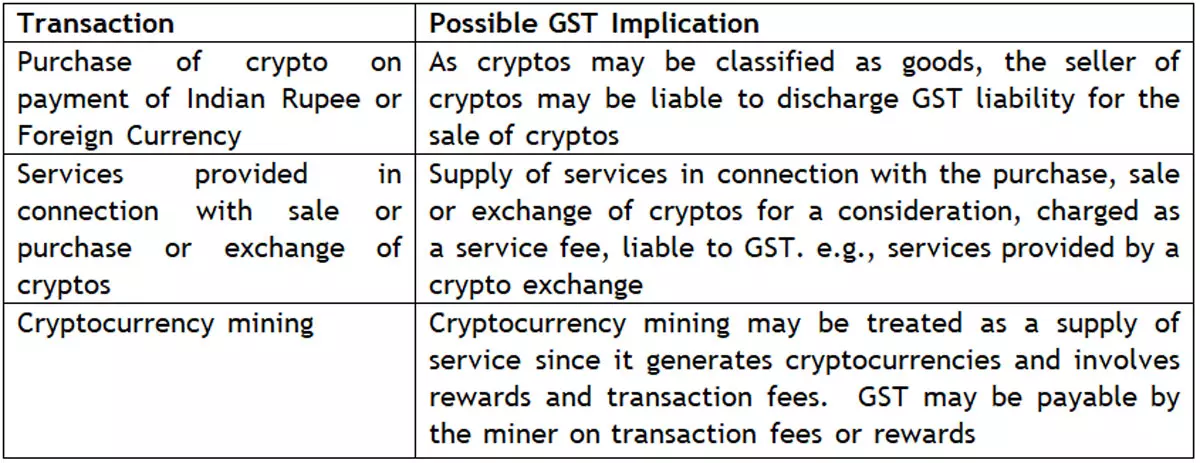

While the Indian crypto community is still dealing with the fallout from the imposition of income tax, media reports indicate that the government is considering imposing a 28 percent GST on crypto activities. Crypto activities include selling and buying crypto tokens on various exchanges, storing them in centralized and decentralized wallets, staking them on various platforms, and mining (generating) crypto.

According to the GST law, ‘goods’ include all movable property other than money and securities. Furthermore, because money refers to legal tender or foreign currency recognized by the RBI, digital assets are not classified as money under GST. Furthermore, digital assets do not fall under the definition of security as defined by GST law.

In the landmark Tata Consultancy Services decision, the Supreme Court’s Constitution Bench established a three-part test to determine whether the software is a “good,” namely (a) its utility, (b) its capability to be acquired and sold, and (c) its capability to be transmitted, transferred, delivered, stored, and possessed. Cryptocurrencies are intangible, have a use case, and are created, distributed, and stored on physical servers.

They can be purchased and sold, transferred, distributed, stored, and possessed. As a result, it can be deduced that cryptos are the closest thing to ‘goods’ and may be classified as such under GST law.

Possible taxability of various crypto activities in India

Clarity on the taxability of crypto transactions, their valuation, and the quantification of tax liability under GST is critical. Ambiguity in the law, combined with slow regulatory implementation, could cause significant hardship for this industry.

Global Crypto Outlook and Indirect Taxes

While there are some exceptions, the vast majority of tax jurisdictions have issued guidelines that recognize cryptocurrency as a form of property. Because it can be exchanged for conventional currencies and used to purchase goods or services, some countries classify it as a currency or form of money, while others classify it as a ‘commodity.’

Different countries have different perspectives on the taxability of cryptocurrency. For example, in the United States, a few states have addressed cryptocurrency transactions in-state sales and use tax laws/guidance, where it is treated as a medium of exchange.

In contrast, there are no clear provisions for the VAT treatment of virtual assets in Korea or other countries. In addition, countries such as Germany, Singapore, Malaysia, and Portugal have exempted cryptocurrency from taxation, subject to certain conditions.

The imposition of cryptocurrency taxes should be viewed positively by the government because it implies the government’s official acceptance of technology. However, cryptos in India have been repeatedly linked to gambling, tax evasion, and other illegal activities, and reports of a 28 percent GST would only add to the industry’s despair.

To regulate the cryptocurrency market and ensure that it not only generates revenue for the government but also sustains and grows in India, a well-thought-out and efficient taxation structure is required.