Nickel Digital Asset Management has put its flagship arbitrage-strategy fund largely into cash after the recent collapse of one the cryptocurrency market’s most reliable trades, a move that’s the antithesis of the sector’s conventional narrative.

The $200 million hedge fund, run by alumni from Goldman Sachs Group Inc. and JPMorgan Chase & Co., isn’t worrying about the anti-fiat fervor that runs though the industry while mulling new trading opportunities before redeploying capital from its Digital Asset Arbitrage Fund. Anatoly Crachilov, the co-founder and the chief executive of Europe’s biggest regulated crypto hedge fund, said he reckons the doldrums will end soon amid signs institutional investors are increasingly interested in the assets.

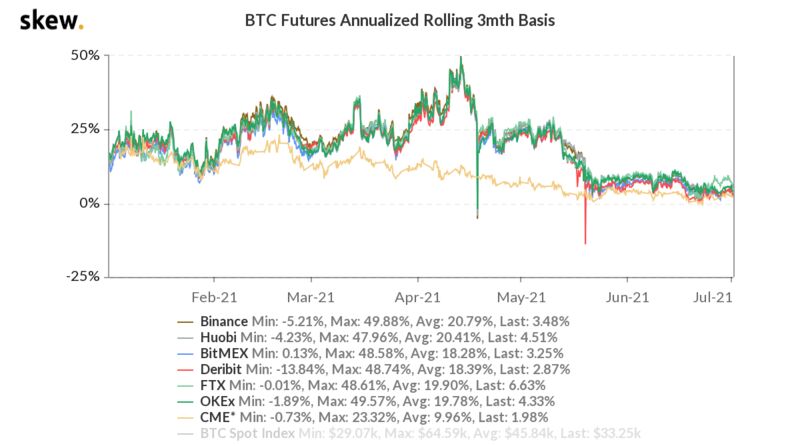

The basis trade, where crypto investors including Nickel Digital profit from discrepancies between spot and future prices, had become a reliable double-digit annual return generator until it was upended in May. The dramatic sell-off saw a number of leveraged positions, mostly held by retail investors, flushed out. Crachilov estimated that the amount of auto liquidations of speculative positions on May 19 alone could be in the region of $9 billion.

“June will be remembered as a cash-rich, wait-and-see month,” Crachilov said in an interview. “The sideways market conditions throughout the month led us to exercise financial discipline and keep powder dry until risk/reward of re-emerging market opportunities warrant efficient deployment of capital.”

Despite the move, Digital Asset Arbitrage Fund remained “mildly positive” in June, thanks to other strategies such as volatility and triangular arbitrages, Crachilov said without elaborating, citing regulatory requirements. The fund has an unbroken record of positive monthly returns since its inception in June 2019. Its year-to-date gain is 12.9%, compared with 3.4% from the nearest benchmark which is HFRX EH Equity Market Neutral Index.

The fund invests across 12 crypto assets, running cross-exchange arbitrage across 17 venues around the world. It’s market neutral, which means it doesn’t make directional bets and only takes advantage from market discrepancies. The company uses computers to help its seven arbitrage strategies, including the basis trade, locate these opportunities in milliseconds. Crachilov said in his career, a second is “an eternity.”

In the crypto world, this type of return may not sound like much. But Crachilov said what the fund offers is more a sustainable, and low volatility crypto investment than outsized returns. Extreme price swings are often cited as a key factor that holds back institutional investors from entering the crypto space even though they see it as a hedge against a broad debasement of traditional currencies. Since its inception, the fund achieved a 29% gain with volatility of 3.5%, compared with 78% in crypto assets.

“We don’t take directional bets, so whether Bitcoin goes up 300% or down 70%, we will seek to capture arbitrage opportunities from market dislocations,” said Crachilov. “Our market-neutral, low volatility strategy is designed to provide positive returns irrespective of market directionality. It’s meant to make a transition into the crypto market easier for investors with lower risk tolerance.”

That strategy helps Nickel Digital attract funds from professional asset allocators, with assets growing from $50 million to $200 million in one year. Crachilov, who became a crypto convert after watching a 12-hour introduction video by Princeton professors, said while the company’s first customers were family offices, it can now boast two asset managers among its 57 clients.

He reckoned more institutions will invest in the coming months after 367 phone discussions with prospective clients this year, including insurers, university endowments, funds of funds, multi-billion hedge funds and traditional asset managers. Most of these investors focus on the long-term prospects of crypto assets and the technology behind it rather than the recent market moves, he said.

“My impression is that interest or investment in crypto assets is no longer considered a reputational risk that it once was among institutional investors,” said Crachilov.

These discussions as well as data such as an increase in digital wallets suggested interest remains strong. That’s why he is optimistic trading opportunities will soon return.

“The investment world has dismissed crypto on every leg down for the past decade, thus far to their detriment,” said Crachilov. “The most recent drawdown is ‘business as usual’ for anyone long enough in crypto business and with familiarity with Bitcoin’s polemical history.”

This article has been published from the source link without modifications to the text. Only the headline has been changed.