The bitcoin bandwagon keeps gaining speed and picking up new passengers: Make room for Elon Musk. The world’s most valuable cryptocurrency rang in 2021 with a string of record highs, stoking renewed crypto interest after the market cooled off a few years ago. Many investors may understandably hesitate at jumping into the still-murky crypto world. But there are other ways to get a piece of the digital currency action—bitcoin futures, for example.

Bitcoin futures trading on CME Group (CME), the Chicago-based exchange operator, surged over the past year in step with the steep rally in the underlying bitcoin currency, which reached an all-time high above $47,000 in early February. Bitcoin’s rally, along with growth in bitcoin futures and other crypto-linked investment vehicles, reflects expanding acceptance of digital currencies, according to JB Mackenzie, managing director, futures & forex at TD Ameritrade.

“We’re seeing more large financial services companies embrace cryptocurrencies or digital payment networks,” Mackenzie said. Cryptocurrencies “won’t replace the dollar, but they’re not going away. Crypto is becoming an increasingly important part of our economy. Its legitimacy is growing.”

For investors seeking crypto exposure but not interested in holding actual cryptocurrencies, bitcoin futures contracts could be a viable alternative, according to Mackenzie. But first, it’s important to understand how futures contracts work and the unique risks in these markets. Here are a few basics about bitcoin futures.

Before exploring the topic, it’s important to note that, as of March 2021, bitcoin futures are the only cryptocurrency product available to qualified TD Ameritrade clients on the thinkorswim platform, and not all clients will qualify to trade them. Visit the bitcoin futures page for more information.

How Are Bitcoin Futures Similar to Other Types of Futures Contracts?

Futures contracts are an agreement to buy or sell an asset on a specific date in the future at a specific price. As is the case in other futures markets, bitcoin futures can be used to speculate on the direction of the cryptocurrency’s price or to hedge holdings of an asset against adverse price moves.

Some commodity-based futures, like corn and crude oil, specify “physical” delivery of the actual commodity at the contract’s expiration. That’s not the case with CME bitcoin futures, which are cash settled at expiration, meaning no actual bitcoin changes hands.

CME’s contract includes five bitcoins and is based on an index, the CME CF Bitcoin Reference Rate, which tracks spot bitcoin trading on independent cryptocurrency exchanges, such as Bitstamp and Coinbase. Based on prices in early February, one bitcoin futures contract for delivery in March had a value of about $226,000.

How Are Bitcoin Futures Different?

Like other futures contracts, CME bitcoin futures can be traded with borrowed money, known as margin, that enables traders to control a large position with relatively little money down. CME’s margin requirements for bitcoin futures, however, are relatively high compared with futures based on interest rates, equity indices, and other markets.

In early February, the maintenance margin for one bitcoin futures contract was about $72,000, or 38% of the contract’s value. For many other futures contracts, margins range from 2% to 12% of a contract’s value. The maintenance margin for one E-mini S&P 500 Index futures contract, at $11,000, was about 5.6% of the contract value.

How Actively Do Bitcoin Futures Trade?

Trading in CME bitcoin futures, launched in 2017, rose sharply over the past year, though it’s still dwarfed by some of the exchange’s older interest rate and equity index-based benchmarks (CME launched options on bitcoin futures in 2020).

During January, an average of 17,549 CME bitcoin futures contracts changed hands each day, up 63% from 10,761 during the same month in 2020, according to exchange data. By contrast, trading in CME’s E-mini S&P 500 Index futures averaged 1.59 million contracts per day in January.

Trading volume is a key indicator of a futures contract’s acceptance in the marketplace: The higher the volume, the greater the “liquidity,” meaning ample buyers and ample sellers are willing to make trades.

Do You Need Special Privileges to Trade Bitcoin Futures?

You first need to have an eligible brokerage account and be approved for futures trading, which requires margin privileges and, typically, options approval. Even if you’ve traded futures before, bitcoin futures’ higher margin makes it critical that you’re fully aware of what your broker requires.

As a TD Ameritrade client you’ll need to have certain permissions, approvals, and enablements in place. The basics include:

- Margin enabled

- Advanced features enabled

- Tier 2 spread option approval

- Futures trading approval

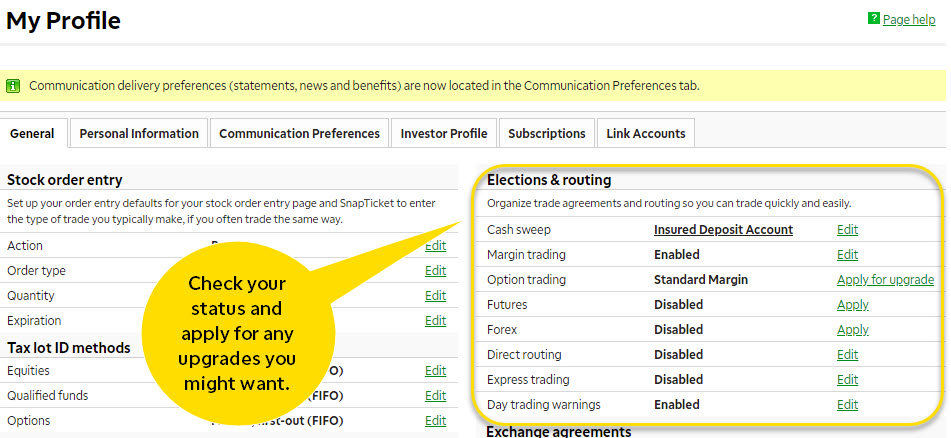

Not sure what your account allows? To check the status, log in to your account and under Client Services, select My Profile and refer to the Elections & routing column on the right (see figure 1).

Also, TD Ameritrade’s margin requirement to trade bitcoin futures is 1.5 times the exchange’s requirement, and you need a minimum account value of $25,000. Learn more about trading bitcoin futures at TD Ameritrade.

Why Trade Bitcoin Futures?

Bitcoin futures closely track the underlying currency and allow traders to play hunches and speculate on the cryptocurrency’s price weeks or months ahead. A speculator who’s bullish on bitcoin could take a long position by buying the futures. Conversely, a bitcoin bear could sell the futures, taking a short position that could profit if the price falls.

There are also hedging opportunities. For example, a bitcoin owner who wants to keep the cryptocurrency long term but is concerned about short-term pullbacks could sell a bitcoin futures contract. If the price of bitcoin falls between now and the contract expiration, the price of the contract will typically decrease and the owner can then buy the same contract at a lower price to close the position before the settlement date. This can help offset the price decline in their actual bitcoin holdings.

Conversely, if bitcoin prices climb, the price of the bitcoin futures contract will also increase, and the owner may have to buy the contract, or wait until settlement, and take a loss at the higher price.

What Are the Risks of Trading Bitcoin Futures?

Futures in general can be more volatile than traditional investments like stocks and bonds. And although futures exchanges such as CME are regulated, bitcoin itself is not, raising the potential for fraud and price manipulation. Also, because bitcoin isn’t housed in bank or brokerage accounts, it’s not insured by the FDIC or SIPC.

What Else Should Bitcoin Traders and Investors Consider?

Even if you’re disinclined to dive into the crypto or futures pools, it’s still worth having bitcoin futures on your watch list, alongside bellwether assets like gold, crude oil, and the U.S. dollar, Mackenzie pointed out.

Cryptocurrencies are still very young, and their relationship with the economy and global markets is still evolving. There’s also the aforementioned Musk. His company, electric vehicle maker Tesla (TSLA), purchased $1.5 billion worth of bitcoin earlier this year and said it would start accepting payments in bitcoin.

“We’ve seen a strong bitcoin correlation with gold and the U.S. dollar, and as a retail investor, it’s a good idea to have these on your radar, even if these assets don’t fit within your risk tolerance or long-term goals,” Mackenzie explained. “Cryptocurrencies are becoming more integrated into the world economy, and as an investor, you want to be aware of anything that moves markets.”

Carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. For additional information, check the TD Ameritrade bitcoin futures page.

Virtual currencies including bitcoin experience significant price volatility, and fluctuations in the underlying virtual currency’s value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Be very cautious and monitor any investment that you make.Like all futures products, speculating in these markets should be considered a high-risk transaction.

This article has been published from the source link without modifications to the text. Only the headline has been changed.