How do you know that today’s most successful NFT blockchain will remain number one in three months?

You don’t, and part of your uncertainty stems from how “successful” is defined. Perhaps obsessing over sales volume was appropriate in the early days of the non-fungible token (NFT) space. While this provides a snapshot of how blockchains rank in terms of a single metric at a given point in time, sales volume cannot be considered the only indicator of current performance. It also cannot be used to predict future performance.

Ignoring other metrics has real-world consequences. On the surface, the value of NFTs and in-game artifacts are reduced, while the price of utility tokens used to operate the platform may be penalized by the market. However, the broader implication is that a blockchain’s sales volume is not indicative of how popular or scalable it may be.

WAX, or Worldwide Asset eXchange, is in a position to form an informed opinion on the subject. While the project’s volume numbers are healthy, its founders are adamant that this is not a sufficient goal for a growing blockchain ecosystem.

Transaction capacity is key

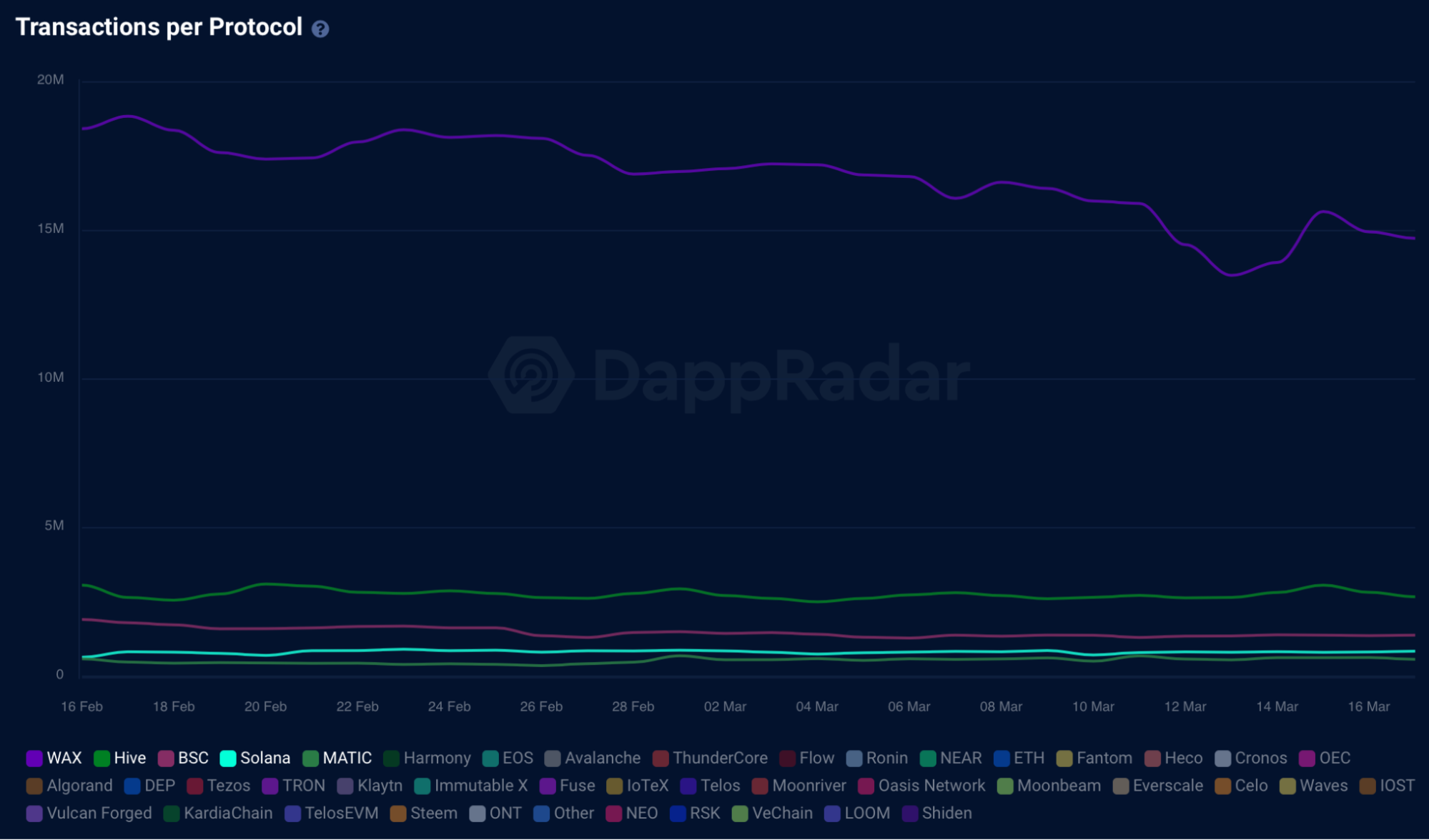

WAX, which is driven by gaming, is the most widely used blockchain in the world, processing more than seven times as many daily transactions as any other blockchain.

In terms of payment processing, this would make WAX the Visa of blockchains, implying that it would compete favorably with Mastercard or American Express, and all stakeholders in business, finance, and the general public would recognize this. But what if they responded, So what? So, you do a lot of business? What a big deal! The entire dollar volume is in ACH!

And they’d be correct. While credit cards are accepted for the vast majority of retail purchases, large-ticket transfers – such as mortgages, car leases, and even payments to credit card companies – are primarily processed through the Automated Clearing House (ACH) Network. However, none of those stakeholders directly compares Visa to ACH. They have two distinct business models and value propositions, and they are essentially complementary rather than competitors. The market recognizes the need for the high-transaction credit card industry and values it accordingly, recognizing that not everyone owns a home or a car – or even a bank account – and thus not everyone uses ACH transfers.

What about the users?

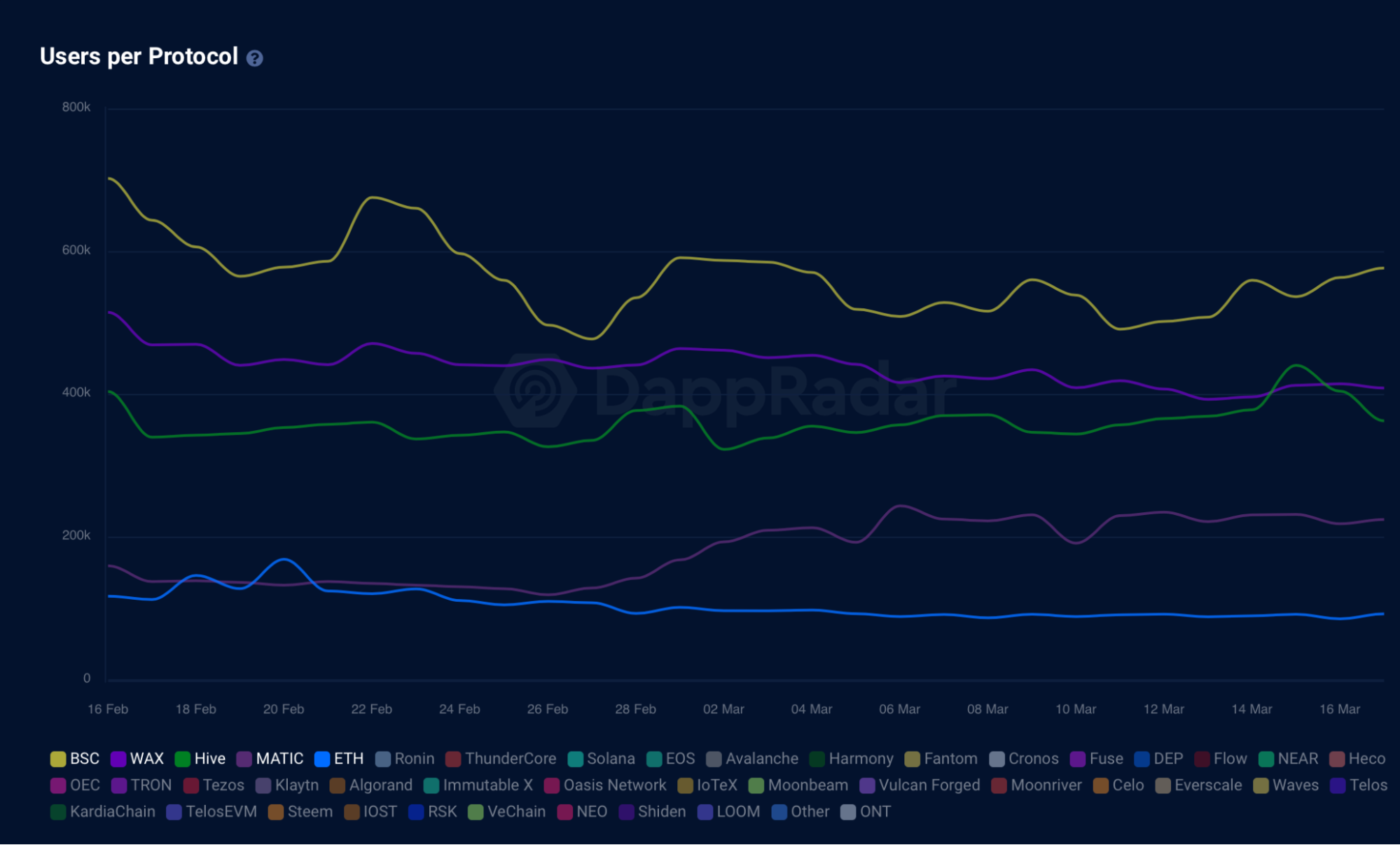

Meanwhile, DappRadar provides relevant metrics that have little to do with turnover – except to imply that turnover will increase or decrease in response to changes in these numbers.

How many smart contracts are there on the blockchain right now? How many dapps are there? Most importantly, how many distinct users are there on the platform?

Again, Web 3.0 appears to be the source of myopia. Web 2.0 metrics, without a doubt, were all about acquiring and retaining new pairs of eyes. While this resulted in some unusual price-to-earnings ratios in the early days, they were ultimately the best predictors of each dotcom’s future success. So, why aren’t Web 3.0 platforms evaluated in terms of user growth, frequency of interaction, duration of interaction, and lifetime value per user?

Because, well, first and foremost. There could be no Web 2.0 without a Web 1.0, which was designed for a personal computer running Windows NT on an i486 chip with approximately 200 MB of hard disc space. CD-ROM was still relatively new, and a solid-state drive would cost at least $1,000. If that wasn’t reason enough for coders to “write tight,” consider that all of their apps and data had to navigate a 4,400-baud modem from one phone jack to another. The technological pipeline simply did not allow for much more than text and the occasional JPEG image.

As those bottlenecks widened, Web 2.0 emerged, and user-based metrics became the most meaningful benchmarks for any online business – and, eventually, all businesses with an online component, which is to say, everyone.

In the case of Web 3.0, the bottlenecks are related to both adoption and technology. While throughput remains a challenge in the blockchain space, solutions are on the way. During the early days of blockchain technology, when transaction speeds were slow and infrastructure was limited, it made sense to prioritize high-value trades over high-frequency trades. In those early days, sales volume was a legitimate predictor of success.

But now, a pivot is not only necessary but also long overdue.

Everyone in the blockchain space has been looking for mainstream adoption, says WAX CEO William Quigley. To find this, a combination of users, transactions, and sales volume must be considered to cut through the noise and spin and discern true platform adoption and growth potential.

Building a dashboard

Finally, a reasonable assessment of a blockchain’s fundamental value must include sales volume, but only as a component of a scorecard, not as the scorecard itself. Even so, it would have to provide different trailing-period timeframes, with the 24-hour figure being the least-emphasized rather than the most-emphasized. The same is true for transaction volumes and unique users.

A meaningful dashboard would also include changes in the number of smart contracts and dapps active on the chain. In a marketplace of ideas, it is necessary to determine how each of these factors compares to one another. Each analyst will create their model, and the best will triumph.

But there’s more to it than that. These platforms are built on technology, and the ability to innovate is ultimately what separates today’s winners from tomorrow’s. This adaptability is more difficult to quantify empirically, but it is necessary to make the effort because scalability is critical.

It’s fantastic if a blockchain cleared 50 million transactions yesterday, but what if it only clears 60 million? As the space matures, the blockchain that cleared 25 million transactions yesterday but is ready to clear 250 million tomorrow is the one that is most likely to win in the long run.