Crypto markets are facing a toll, with ether (ETH) down 36% from its November high due to the downturn of the market recently. However, the impact on network activity like transaction fees, the trading volume of decentralized finance (DeFi), and borrow rates across lenders, are likely to be noticed more.

Ether and ERC-20 wallet transfers are being incorporated in blocks at a fraction of the cost seen in December and January. While this is a more calculated rigorous transaction than wallet transfers, here is a user switching one asset for another for a fee of only 0.0064 ETH ($20.04). A similar transaction in March, last year charged a different user 0.04 ETH ($125.18), which was more than six times the price of the February 15 transaction.

The comparison is not one-to-one, since contracts are becoming more gas efficient with progressing time and varying levels of activity throughout the day. However, studying it can show the dropping level of the transaction costs.

Impact of EIP 1559 on Ethereum fees

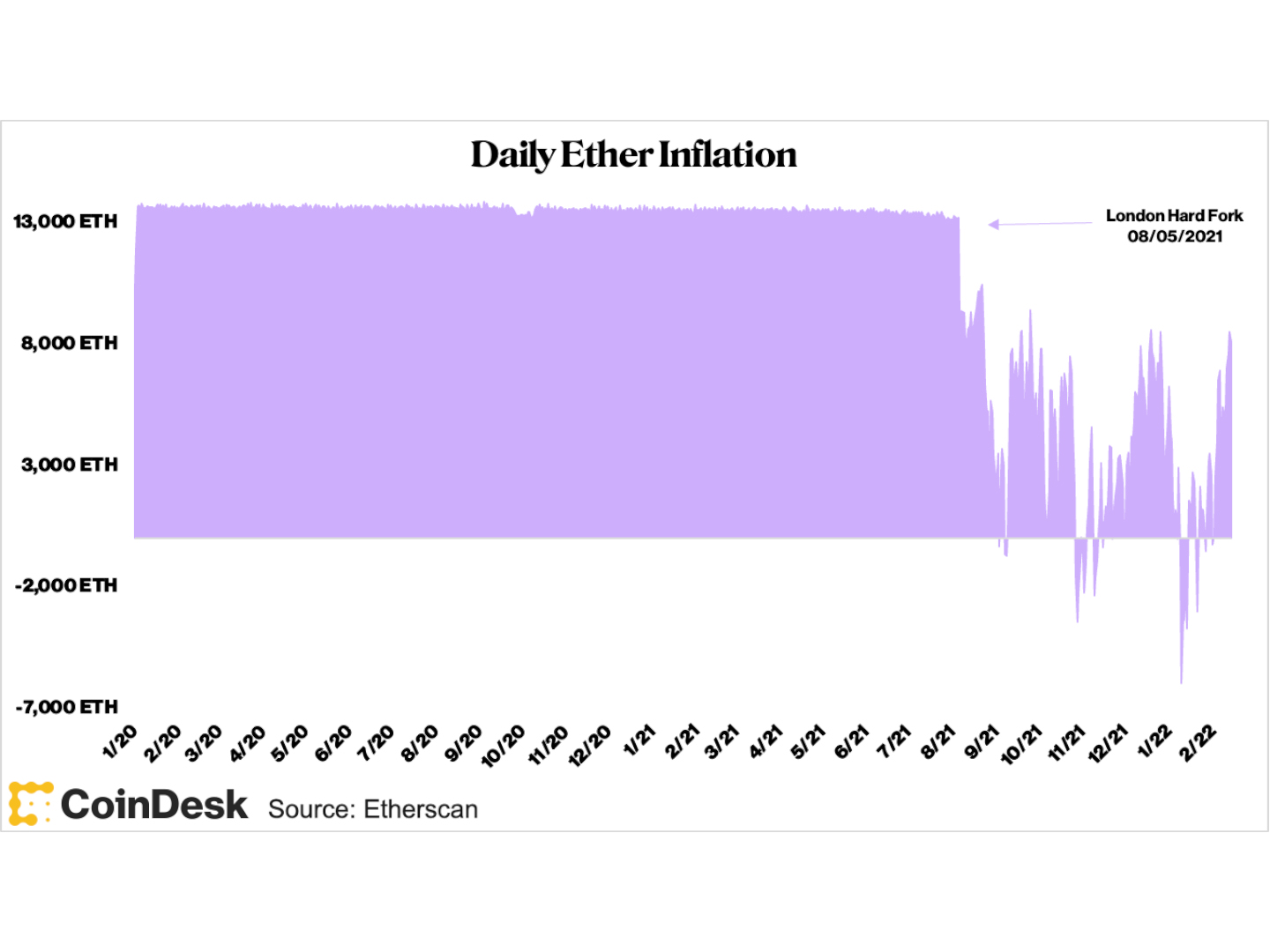

Since the activation of EIP 1559 in August 2021, a base fee has been set for every block that should be paid in ether for inclusion in a block. To avoid volatility, these base fees can only be accommodated by 12.5 percent up or down after every block, based on whether the previous block exceeded or fell short of the gas target fixed by Ethereum core developers.

Every transaction’s base fee is sent to a burn address, a mechanism permitting the native asset, ether, to behave practically like gas in a car. An important point to be taken into account is that the burn mitigates the inflation caused by block rewards and contributes to the long-term viability of both the Ethereum network and its native asset.

By lowering fee volatility, the network has protected itself from transaction fees skyrocketing in a short period due to non-fungible token (NFT) mints or token launches. However, the opposite is true, and it may take weeks for transaction fees to fall remarkably during prolonged periods of low activity.

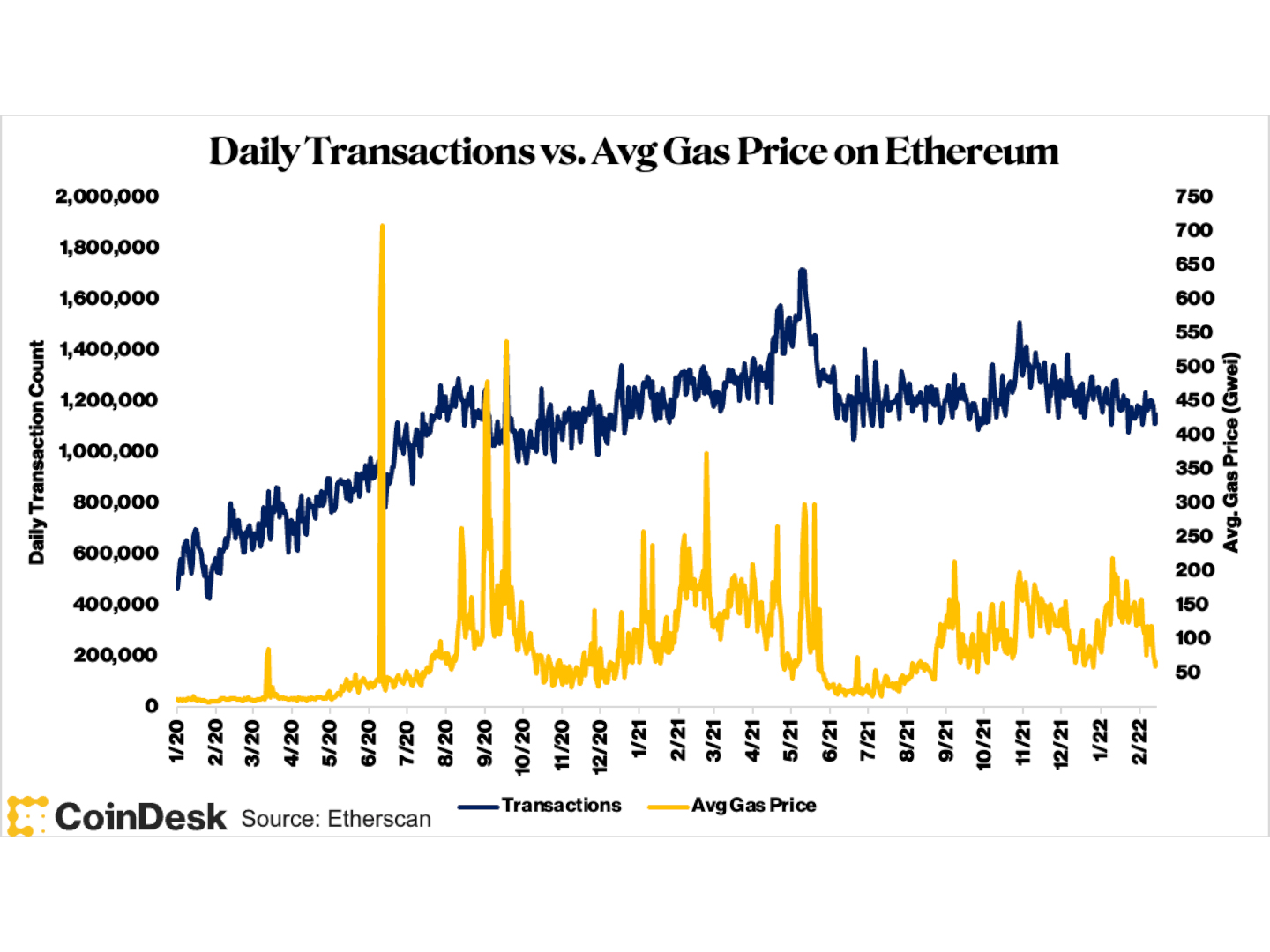

The below charts highlighting this low volatility also indicate falling gas prices every month and a downward trend in daily transactions since November last year. The larger outcome on the network is lower fee burning and elevated ether inflation, which has only occurred twice since the implementation of EIP 1559.

A drop in the transaction fees may be great for the user experience, however, it is not a good indication for the network as a whole. Although network activity will always be in association with crypto asset prices, the excessive linkage between the two could lead to an indication that most of the Ethereum applications are focusing on asset contemplation rather than real-world adoption via decentralized products such as insurance, gaming, payments, etc.