Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is in a good position to continue benefiting from AI.

The advantages of AI for Google Search are clear. We are still in the early stages of AI development, CEO Sundar Pichai remarked in the 3Q22 call, citing BERT [Bidirectional Encoder Representations], which acknowledges that little search phrases like “to” and “for” might be crucial. The advantages of AI for Google’s other businesses, such as YouTube and Google Cloud, are less well-known. In the 3Q22 call, CEO Pichai discussed these factors:

It makes YouTube’s advertisements better, and we are delivering it to other businesses through Cloud.

AI Improves YouTube

Google has a distinct advantage in that it uses the AI investments made in the search industry to enhance the YouTube ad business, which has a huge viewership. According to Nielsen, YouTube accounted for roughly 22% of streaming time and 7.6% of total US TV time in August.

In the 3Q22 call, COO Philipp Schindler discussed the prospects at YouTube and noted that more than 700 million hours of YouTube content are seen everyday by users worldwide. He disclosed that, according to Nielsen, during the 2021–2022 U.S. broadcast seasons, YouTube attracted more viewers than any other linear TV network during primetime on CTV:

Linear TV is losing viewers, and we are assisting companies in stepping outside of the box to effectively fulfil their reach and awareness objectives. Naturally, you also said that Connected TV is a key component of this plan. When you stop to think about it, YouTube is actually the finest platform for brands to reach new audiences across a variety of formats and screens, including shorts, long-form content, podcasts, music, and CTV.

The number of times a viewer sees an advertisement from a particular business is optimised by YouTube using machine learning, according to a May 2022 blog post by Cenk Bulbul, Director of Global Advertiser Marketing. Both viewers and advertisers benefit from an improved advertising experience as a result.

YouTube Product Management Director Nicky Rettke discusses how machine learning aids advertisers in converting landscape video advertising into square or vertical formats:

As someone watches YouTube, a new machine learning approach we’re exploring with resizes landscape video ads into square or vertical layouts. The movie is divided into discrete “scenes” by the machine learning model, which recognizes significant features in the landscape advertisement such as faces, major objects, logos, text, and motion. This guarantees that crucial components of the reformatted video appear properly, such as centered. This technology, which automatically adjusts current content for various formats, can readily help businesses that may not have the resources to generate multiple products.

Customers can now access AI thanks to Google Cloud

At Next ’22, we learnt about the ways Google provides enterprise-grade products and solutions, such as Vertex AI, to cloud clients as a result of their AI research, AI models, and ML toolkits. Ashish Vijayvargia, Product Lead at Vodafone Analytics, describes the platform they created using Vertex AI:

We’re tremendously delighted to have developed a cutting-edge MLOps platform as a technological platform, based on best-in-class Google Cloud architecture with built-in automation, scalability, and security. As a result, we are utilizing data science more effectively and incorporating reliability engineering principles everywhere.

At Next ’22, Google CEO Sundar Pichai discussed how machine learning is a crucial component of their translation efforts. He said that they are now up to 135 languages. As an example of a business employing Google’s machine learning to get insights and predictions from data, CEO Pichai cited Munich Re:

The capacity to draw insights and predictions from data that are tailored to an organization’s needs is one of the most potent AI applications for businesses. For instance, one of the top reinsurance businesses in the world, Munich Re, is working with Google Cloud to employ AI to effectively and swiftly respond to natural disasters. Our resources assist them in creating more effective damage reduction models more quickly and economically. This shortens the time it takes to respond and helps get resources and people where they are most needed.

Data scientists can create and train ML models 5 times quicker with Vertex AI, according to a Next ’22 presentation by Google Cloud Senior Director of Engineering Kamelia Aryafar @KAryafar. At Next ’22, Google Cloud Analytics Product Leader Irina Farooq provided us with more information regarding the results Vodafone is seeing with Google’s ML. Irina Farooq, the product leader, emphasised that data is ingrained in Google’s DNA and that Google Cloud customers can access the same data infrastructure that has enabled them to create. According to Product Leader Farooq, Google has helped Vodafone run AI development 80% faster.

Valuation

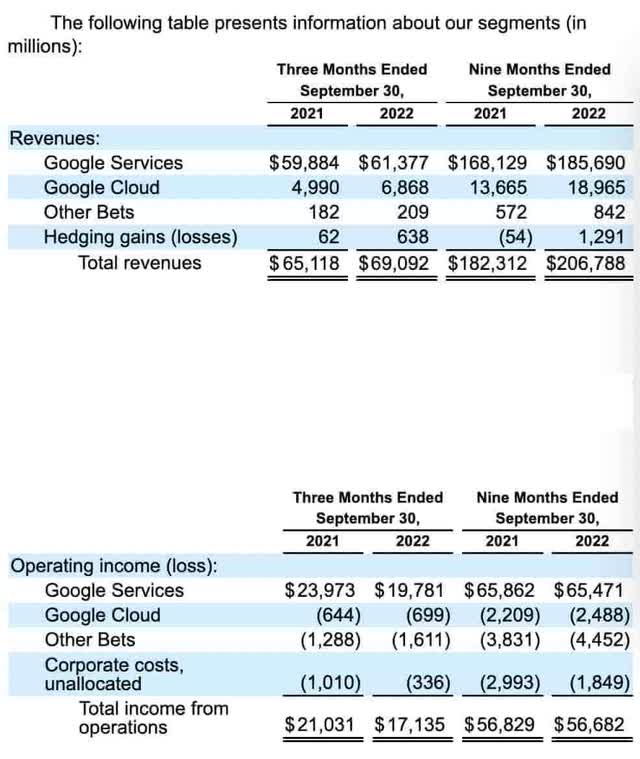

CEO Pichai stated during the 3Q22 call that both Cloud and Search have seen fundamental growth. Foreign exchange, the macroeconomic environment, and the end of a high period have all presented difficulties. In the 3Q22 call, CFO Ruth Porat stated that the quarterly sales of $69.1 billion was up 6% from the same period last year or 11% in constant currency. Since many of the costs associated with research and development are incurred in the United States, she said that an even greater foreign exchange headwind is anticipated in the fourth quarter. 12,765 new employees were hired in the third quarter of 2012, and 2,600 of them came from the Mandiant acquisition, according to CFO Porat.

In the third quarter of 2022, Google hired 51,000 new employees, according to Morgan Stanley’s Brian Nowak. Investors are concerned that this personnel increase is significantly lagging revenue growth.

In the 3Q22 call, Google COO Schindler discussed some of the revenue challenges:

Certain advertisers’ spending on both brand- and direct-response advertising decreased more in the third quarter. YouTube is still in a great position to continue profiting from the streaming explosion. In terms of direct response, there is still a lot of potential for improvement in terms of making it more shoppable and actionable across product feeds, app campaigns, and live commerce capabilities.

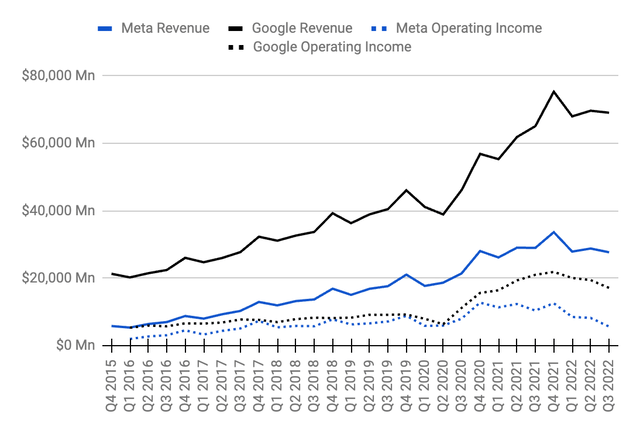

Much of Google’s operating income and revenue, like Meta (META), comes from online advertising. Although things have recently slowed considerably, there is still great potential for long-term growth in this area:

Looking at 3Q22 relative to 3Q21, revenue is up but operating income is down per the 3Q22 release:

Google Cloud is comparing their statistics to those from Amazon (AMZN) AWS, which we first saw four years ago. AWS went out there early, ahead of the competition, so they didn’t encounter the same kinds of difficulties that latecomers like Google Cloud did. In some respects, this is unfair. The stats are still telling, though! At comparable revenue levels, operational profitability was never an issue for AWS.

Google Cloud’s operational income will eventually turn positive, but it’s been a long wait. AWS increased its operating income from $580 million on $2,405 million in revenue in 4Q15 to $2,077 million on $6,679 million in revenue in 3Q18. Google Cloud increased its operating income from $(1,194) million on revenue of $2,614 million in 4Q19 to $(699) million on revenue of $6,868 million in 3Q22.

Here are the figures in millions:

| Google Cloud

Qtr End |

Google Cloud

Op. Inc. |

Google Cloud

Rev. |

AWS

Qtr End |

AWS

Op. Inc. |

AWS

Rev. |

|

| Dec 2019 | -$1,194 | $2,614 | Dec 2015 | $580 | $2,405 | |

| Mar 2020 | -$1,730 | $2,777 | Mar 2016 | $604 | $2,566 | |

| Jun 2020 | -$1,426 | $3,007 | Jun 2016 | $718 | $2,886 | |

| Sep 2020 | -$1,208 | $3,444 | Sep 2016 | $861 | $3,231 | |

| Dec 2020 | -$1,243 | $3,831 | Dec 2016 | $926 | $3,536 | |

| Mar 2021 | -$974 | $4,047 | Mar 2017 | $890 | $3,661 | |

| Jun 2021 | -$591 | $4,628 | Jun 2017 | $916 | $4,100 | |

| Sep 2021 | -$644 | $4,990 | Sep 2017 | $1,171 | $4,584 | |

| Dec 2021 | -$890 | $5,541 | Dec 2017 | $1,354 | $5,113 | |

| Mar 2022 | -$931 | $5,821 | Mar 2018 | $1,400 | $5,442 | |

| Jun 2022 | -$858 | $6,276 | Jun 2018 | $1,642 | $6,105 | |

| Sep 2022 | -$699 | $6,868 | Sep 2018 | $2,077 | $6,679 |

The totals listed above are mind-boggling. Google Cloud incurred operating losses of more than $12 billion over the course of 12 quarters. AWS went the other way at comparable sales levels, with operating profits of $13 billion spread across 12 quarters.

In certain aspects, Google Cloud’s operating income losses are beneficial to hyperscale cloud providers. This is due to the fact that few organisations in the world can overcome this barrier to entry; AWS, Azure, or Google Cloud will face new hyperscale competitors in the foreseeable future.

Did you know that more than 90% of Google Data Cloud customers also use Google’s Data Cloud to access and analyse data from other clouds? Without actually moving the data, BigQuery Omni enables you to analyse data kept in AWS, Azure, and other locations, saving you egress fees. Customers can then examine the data using BigQuery’s built-in machine learning capabilities, [CICO] searches, and Spark programmes.

Given that the Google Cloud division’s operational profitability is still negative, valuing it can be challenging. One way to be positive is to predict that they’ll eventually achieve an operating margin like what we’ve seen at AWS over the past few years. According to the Amazon 2021 10-K, the operating margin for AWS was 29.82% for 2020 ($13,531 million/$45,370 million) and 29.97% for 2021 ($18,532 million/$62,202 million). Perhaps AWS will consistently have the biggest margins among the hyperscale businesses. Despite this, Google Cloud can eventually reach an operating margin of 15% to 20%, or roughly half to two thirds of what we observe at AWS.

Based on a yearly sales of $27,472 from the $6,868 million number in the 3Q22 quarter, Google Cloud’s operating income would be approximately $4,120 million to $5,494 million if it had a 15% to 20% operating margin today. The Google Cloud business might be valued $75 to $110 billion if we multiply these numbers by 18 to 20 and round to the nearest $5 billion.

The “Other Bets” sector shows TTM operating losses of $5,902 million, or 9M22 + FY22 – 9M21, or $(4,452) million + $(5,281) million – $(3,831) million. However, the specifics of this segment are obscured. In light of these significant operating losses, in the current climate of rising interest rates, this division may be worth $0.

Operating income for the services business for the TTM period is $91,464 million, or $65,471 million plus $91,855 million minus $65,862 million. When adjusted to the closest $10 billion, this segment is worth 18 to 20 times this amount, or $1,650 to $1,830 billion.

$1,650 to $1,830 billion Google Services

$75 to $110 billion Google Cloud

$0 Other Bets

$1,725 to $1,940 billion Total

GOOGL closed at $96.29 on October 28 while GOOG closed at $96.58. We divide these by the A/B and C share numbers, which, according to the 3Q22 10-Q, were 6,857 million and 6,086 million, respectively, as of October 18. Our market capitalization now stands at $1,248 billion, or $660.3 billion plus $587.8 billion. Because there is $22 billion in cash and $94.3 billion in marketable securities, which are only partially offset by debt and leasing obligations, the enterprise value is much lower than the market cap.

For long-term investors prepared to keep the stock for at least a few years, the stock is a buy because the market cap and enterprise value are far below my valuation range.

Disclaimer: Nothing in this post should be taken as a formal suggestion for investing. Never purchase a stock without conducting extensive independent research.