Michael Barr, the Vice Chair of the Federal Reserve’s Supervision Committee, has cautioned against the unregulated nature of stablecoins, or cryptocurrencies linked to a stable asset such as the US dollar, and underlined the significance of federal oversight in this area.

According to Barr in D.C., if a private sector organization is developing a stablecoin that is linked to a fiat currency—in this case, the US dollar—they are producing a form of private money, and private money requires strict regulation.

He emphasized the necessity of this regulation, restating remarks from October that highlighted stablecoins’ potential to undercut the central bank: An asset is considered to be private money if it is linked to a currency that is issued by the government. According to Barr, an asset borrows the confidence of the central bank when it is utilized as a store of value and a method of payment.

He continued by saying that the Federal Reserve has a strong interest in making sure that any stablecoin offerings function within an appropriate federal prudential oversight framework and do not jeopardize the integrity of the payments system or financial stability.

Barr nevertheless emphasized to audiences this week in Washington, D.C., that understanding emerging technologies like stablecoins is crucial, even though they might be dangerous: Barr stated that there is evidently a great deal of innovation surrounding stablecoins in the private sector. The objective is to ensure that we can utilize this innovation to enhance the payment system’s efficiencies.

Tether, a stablecoin that is pegged exactly to the US dollar, has seen its market capitalization soar by $85 billion, despite the fact that the cryptocurrency industry has taken many hits during the harsh 2022 crypto winter.

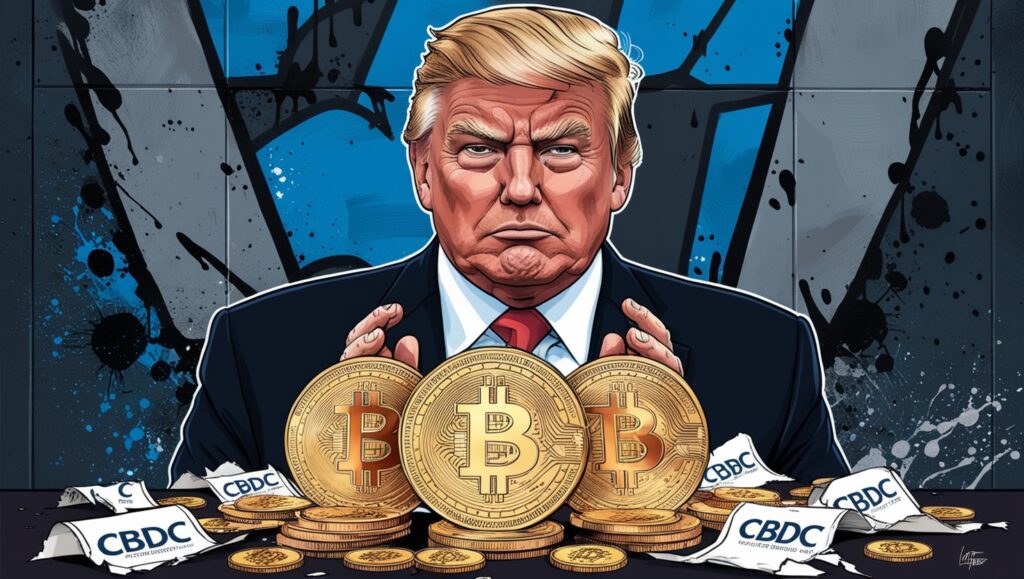

Another controversial topic that Barr addressed this week was central bank digital currencies (CBDCs), stating that the government had not yet decided if it was prudent to advance the technology: Barr stated that they still haven’t decided if it would be a good idea or not.

However, a lot of supporters of cryptocurrency assert that CBDCs are a means of government financial surveillance. Politician Tulsi Gabbard attacked CBDCs, saying they were stealing our freedom, at the Bitcoin 2023 conference held in Miami earlier this year.

“We forfeit our freedom the moment we lose our economic independence,” Gabbard declared. Someone controls our freedom the moment they gain control over our finances.

A bill to stop the government from issuing a CBDC was also unveiled by Texas senator Ted Cruz this past spring.