The most frequently asked question I get from people with a new interest in crypto and blockchain technology is how to get investment exposure to the asset class. In this article, I’m going to tell you what options are out there, what, from my view, the respective pros and cons of each are, and, most importantly, which way may suit you best based on your investment size, risk profile, tech understanding and the amount of effort you want to put in.

Before going into detail, you don’t have to buy a whole Bitcoin or a whole Ether; you can invest into crypto even with a few cents. One of the beautiful things about crypto is its fragmentation (normally 8-18 decimals). For Bitcoin, the smallest unit is called a Satoshi and for Ether its Wei.

This means that even if Bitcoin skyrockets to $100,000,000 one day, you could still invest in one Satoshi with 1 dollar. But let’s get back to the topic at hand… how can you get exposure and what is the best option for you?

Direct Investments

The most native and “honest” way to get exposure is through buying the coins themselves, directly. This is possible in several ways.

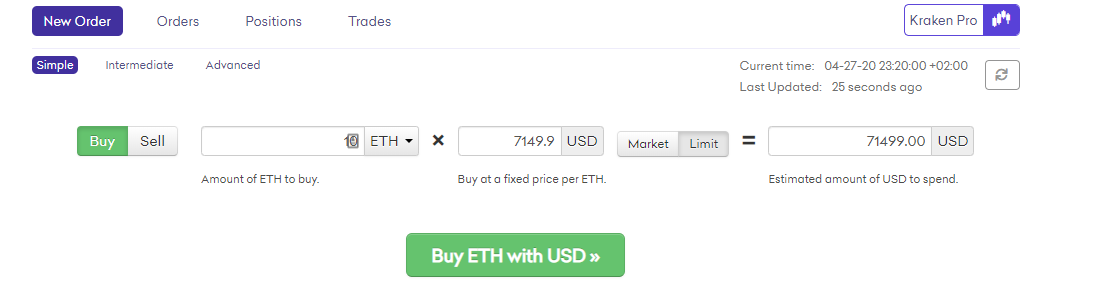

The most common and well-known way is to sign-up at a centralized crypto exchange like Kraken, Binance or Bitfinex. My advice is to choose a regulated and reputable exchange since this already mitigates some of the cybersecurity and counterparty risks. Once you’ve gone through the KYC and AML checks, which can admittedly be annoying, you can wire money from your bank account to the exchange.

Once the money is there you can finally invest in your chosen crypto asset. You don’t need to install any software to store the assets, they’ll be stored on hot storage on the exchange. If you invest a significant amount though, it’s highly recommended to install a wallet for your computer (like Metamask for Ether) or to order a hardware wallet device like the nano ledger for the highest security. This takes more time, can be confusing and is mainly for tech-savvy investors. The benefit of installing and managing a wallet is that you really get in touch with the underlying technology, but you’re also exposed to certain other risks like losing your seed phrase. Here is an overview of some terminology related to wallets:

Hot wallet refers to any cryptocurrency wallet that is connected to the internet. Generally hot wallets are easier to set up, access, and accept more tokens. However, hot wallets are also more susceptible to hackers, possible regulation, and other technical vulnerabilities.

Cold storage refers to any cryptocurrency wallet that IS NOT connected to the internet. Generally, cold storage is more secure, but they don’t accept as many cryptocurrencies as many of the hot wallets. Cold storage devices (aka. Trezor, Ledger) also cost close to $80, whereas hot wallets are generally free.

A seed phrase, or seed recovery phrase/backup seed phrase is a list of words which store all the information needed to recover cryptocurrency funds on-chain. Wallet software will typically generate a seed phrase and instruct the user to write it down on paper. If the user’s computer breaks or their hard drive becomes corrupted, they can download the same wallet software again and use the paper backup to get their Bitcoin or cryptocurrency back.

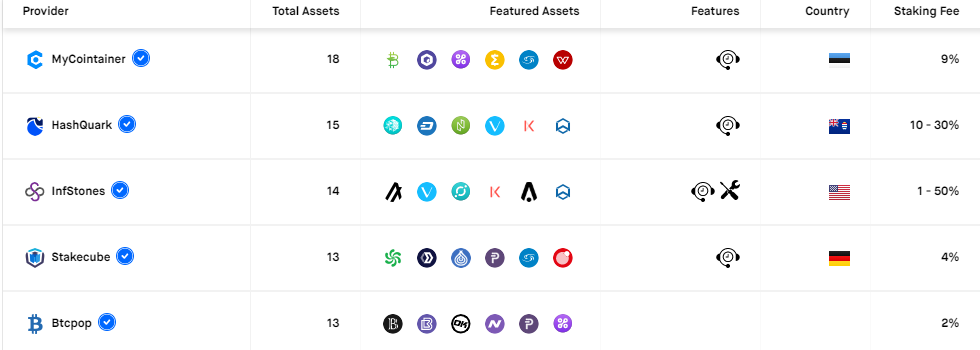

Some exchanges might even offer you convenient services like staking or lending so you may earn money in crypto by basically doing nothing. It’s probably best compared to a stock’s dividend. Staking is the process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network. Essentially, it consists of locking cryptocurrencies to receive rewards. But please be cautious, there are severe risks and a lot of the service providers are not regulated and are lacking financial markets familiarity. However, if done correctly, there is some extra income to make.

The second most popular method to buy crypto is on a decentralized exchange like IDEX. For these trading facilities, you need to understand the market and the tech behind a little bit better. You may connect your wallet to the decentralized exchange and then you can start trading. A lot of the marketplaces still do not have a strict KYC and AML process and you are more anonymous. There are always some arbitrage possibilities since the prices frequently differ from the quotations at high volume exchanges, in particular for smaller coins.

Professional traders and asset managers can also approach an OTC desk like B2C2 or Cumberland. The OTC desk will match a buyer and a seller which, in most cases, want to trade a big amount and prefer to do the trade with one counterparty and recognize minimal slippage on their larger trading orders.

Blockchain ETFs

If you want to get exposure to blockchain technology, and not cryptocurrencies per se, you might have already considered buying a traditional Blockchain ETF like the Invesco Elwood Global Blockchain UCITS ETF. While it is very convenient to order in a traditional manner and you’re most likely familiar with such structures, it doesn’t really offer you any sort of real crypto or public blockchain exposure. They invest in listed equities of companies which have some connection to blockchain like IBM (Hyperledger) or Nvidea (computing power for Bitcoin mining). So, yes, it might make sense to allocate this to a balanced portfolio, but I would categorize this as a general tech investment that clearly has more allocation to the Nasdaq than to crypto assets themselves.

Listed Crypto Derivatives

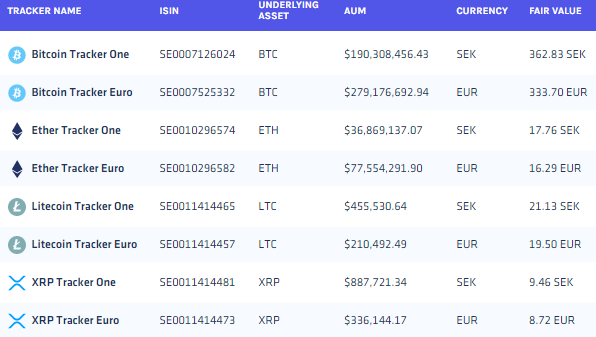

Today there are also a couple of certificates trading on the open market from issuers like Coinshares (via XBT Provider) or Vontobel, which mostly focus on single asset strategies. This is very convenient as you just need the ISIN and then you can order it with your favorite broker or investment manager. Also, you don’t need to set up a wallet since the asset manager (issuer of the certificate) is in charge of the custody and you’re less exposed to cybersecurity risks.

With the products being listed you also have a certain degree of flexibility. You can execute orders daily on the market and monitor the performance continuously. But naturally, this also comes with some added costs, such as a 2-3 % management fee per year. Further, the bid-ask-spreads (IE, difference between buy and sell prices) are often higher than trading the underlying asset itself. In your due diligence, you should have a look at the issuer, the replication strategy and whether or not your assets have some sort of insurance.

There are also providers of cryptocurrency futures and options like the CME group. You can hedge Bitcoin exposure or harness its performance with futures. Future contracts involve a certain expiration date. One common drawback of investing in future contracts is that you don’t have any control over future events, the most recent example was the oil price (WTI futures) in the corona crisis. Additionally, the contracted prices for the crypto assets can become less attractive as the expiration date comes closer.

Non-listed funds

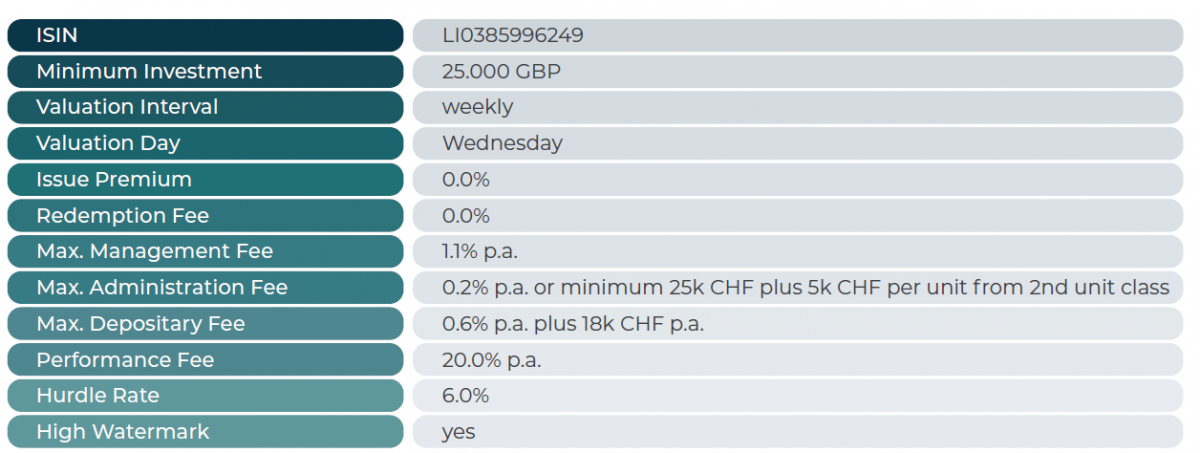

There are also other financial vehicles such as AIFs, Trusts or VC funds that have crypto as an underlying. Grayscale, through their Trusts, may be the most prominent crypto asset manager in the US and Postera Capital issued the first European regulated AIF for crypto assets. Those vehicles differ a lot from each other and, as a result, have very distinct benefits and downsides. In most of cases, the overhead costs of these vehicles may include a management and performance fee on top pf an an onboarding and exit fee in addition to custody and administration fee. All in all, this can lead to a total cost ratio upwards of 30 percent, depending on the manager and vehicle set up. Some of these vehicles also trade OTC at a price significantly higher than the underlying net asset value. If this is a very professionally managed, active vehicle which generates alpha in a bull market and protects its positions in a bear market, this may make up for the additional fees, but normally that’s not the case. Additionally, you’re less flexible in terms since your money is at least locked, typically for one year, and sometimes for up to 10 years, dependent on the nature of the vehicle.

So, if you do your due diligence here, make sure you have checked the manager’s track record and benchmark their past performance to the market. Did they outperform Bitcoin after deducting the fees from their performance?

Conclusion

Personally, after having bought, sold and held crypto for several years, I have decided to sell most of my crypto assets on the exchanges because it was just too time-consuming and bothersome to manage it on my own. I have allocated all of my crypto holdings to a professionally managed crypto fund because I know the team employs way more security mechanisms than I can and I am “only” exposed to the asset class risk of crypto.

So, what are the main take-aways I wish to impart to you:

• Everyone can invest into crypto, even with a few cents

• There is no right or wrong answer for how to get exposure

• Make sure you do your own research and due diligence

• Ask yourself, do you want convenience or the real crypto experience?

This article has been published from the source link without modifications to the text. Only the headline has been changed.