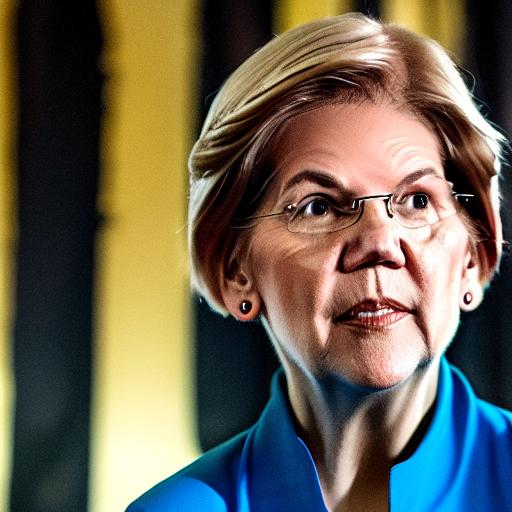

Senator Elizabeth Warren, a seasoned critic of cryptocurrencies, cautioned that unless numerous regulators tighten investor protections, recent instability in the digital asset market will only persist.

For all their promises of innovation and financial inclusion, crypto industry titans — from FTX to Celsius to Voyager — are falling under the weight of their own fraud, dishonesty, and bad mismanagement, she claimed.

At a gathering organized by the American Economic Liberties Project and Americans for Financial Reform on Wednesday, Warren (D-Mass.) continued, And when they sink, they pull a lot of honest investors down with them.

Last year, as asset values plummeted and the market capitalization of cryptocurrencies fell by over $2 trillion, FTX, Celsius, and Voyager all declared bankruptcy. Several former FTX executives, including the company’s founder Sam Bankman-Fried, have been accused by federal prosecutors of planning one of the largest financial scams in US history.

The FTX crash in November set off a chain reaction that is currently reverberating throughout the crypto markets, which are still mostly unregulated and opaque.

Warren urged regulators, such as the Securities and Exchange Commission and banking authorities, on Wednesday to use their existing tools more aggressively. Customers need to be safeguarded, investors need to be educated, and bad actors need to face “real penalties,” she said.

Crypto fraud “is a serious problem, but it’s one we can fix,” Warren added.

She claims that by keeping cryptocurrency volatility out of the traditional banking system and prohibiting the introduction of Bitcoin exchange-traded funds during the past two years, the SEC has made “a solid start.” Warren also praised the SEC for accusing “crypto fraudsters” of defrauding common investors without particularly referencing Bankman-Fried.

The SEC can’t, however, make everything right.

Warren urged environmental and banking officials to step up, saying “all our regulators need to get in the game.”

Communities from Texas to New York are being negatively impacted by cryptocurrency mining companies, which also strain power networks and increase utility rates. Crypto miners must declare their energy use and environmental impact, according to the Environmental Protection Agency and the Department of Energy, respectively.

The emergence of banks that are supportive of cryptocurrencies, according to Warren, has already exposed the conventional banking system to more risk, “creating the threat of a crypto collapse in which American taxpayers are left holding the bag.”

It is the responsibility of bank regulators to protect the financial system, as well as taxpayers, against the risk of cryptocurrency fraud. They must utilize the resources they have at hand.

Warren concluded by saying that in cases where regulators do not have the necessary power to execute the law, Congress must provide those agencies with those resources.

She addressed the crypto supporters who have long resisted the idea of further regulation in her signature direct manner.

She claimed, tougher regulations, would give the sector a chance to establish whether it can deliver on its promises of innovation without stealing investors or laundering money for drug traffickers and terrorists.

No financial institution should be allowed to create its own rules; breaking the law carries serious penalties. Crypto is no different.