Prices:

Bitcoin and other major cryptocurrencies are declining as Russia intensifies its attack.

Technician’s viewpoint:

Intraday charts display downside exhaustion, which could inspire BTC buying in the short term.

Prices:

Bitcoin (BTC): $42,528 -3.2%

Ether (ETH): $2,839 -3.8%

Top Gainers

| Asset | Ticker | Returns | Sector |

| Cosmos | ATOM | +4.8% | Smart Contract Platform |

| Internet Computer | ICP | +3.0% | Computing |

| Ethereum Classic | ETC | +2.2% | Smart Contract Platform |

Top Losers

| Asset | Ticker | Returns | Sector |

| Solana | SOL | −5.3% | Smart Contract Platform |

| Ethereum | ETH | −4.1% | Smart Contract Platform |

| Cardano | ADA | −3.7% | Smart Contract Platform |

Bitcoin and other major cryptocurrencies fell on a gloomy Thursday in Ukraine.

Bitcoin was trading at around $42,500 at the time of publication, down more than 3% in the previous 24 hours. The second-largest cryptocurrency by market capitalization – Ether, was trading at around $2,800, down roughly 4% from the previous day. The majority of the other cryptos were in the red.

Russian forces seized Kherson, a port city in southern Ukraine with a population of about 300,000 people and a ship-building hub, and continued to seize vast swaths of the region because of its access to the Black Sea. Rockets and cluster bombs rained down on Ukraine’s major cities, and over one million people escaped the now-war-torn country, including Asian students and workers.

Meanwhile, as cryptocurrency and other contributions poured into the country, the Biden Administration appealed $10 billion in humanitarian and defense aid and inflicted fresh sanctions on Russia. The invasion of a sovereign country has shone a light on cryptocurrency’s potential as a means of conducting transactions outside of conventional financial services networks.

Earlier in the week, investors were upbeat about this development. However, momentum has waned as investors have shied away from riskier assets in the last two days.

In an email, OANDA Americas Senior Market Analyst Edward Moya wrote, Bitcoin’s rally is beginning to display signs of exhaustion. Bitcoin requires a healthy risk appetite for prices to rise above $50,000, so it should not be surprising if prices consolidate around the level of $40,000.

Markets

S&P 500: 4,363 -0.5%

DJIA: 33,794 -0.2%

Nasdaq: 13,537 -1.5%

Gold: $1,936 +0.4%

Insights

Russia’s financial isolation, as well as the influx of cryptocurrency contributions into Ukraine, have heightened interest in governments’ cryptocurrency initiatives and the possible role of digital assets.

An imperialist of growth according to Reuters, China, potentially a greater contender to the US-led rules-based order than Russia, will shortly favor the third batch of localities set to launch testing of its digital yuan currency, citing state-backed fiscal outlet Securities Times. According to the report, several cities and regions have appealed to officials for authorization to test digital yuan, which includes Guangzhou, Chongqing, Fuzhou, and Xiamen.

Meanwhile, the South China Morning Post reported that Western sanctions inflicted on Russia after the invasion of Ukraine, including eviction from the SWIFT financial messaging system, may provide fresh development opportunities for China’s digital currency and its native yuan cross-border payment system.

An analyst wrote that it is needed and urgent to vigorously promote yuan internationalization, particularly the development of the CIPS system (Cross-Border Interbank Payment System set up for boosting global utilization of China’s currency in trade settlements) as well as the digital yuan.

However, China’s cryptocurrency narrative appears to be centered on its central bank’s digital currency, or e-yuan. According to a note issued by the Chinese central bank’s Financial Stability Bureau, China’s share of bitcoin transactions has dropped by 80 percentage points since the government’s crackdown.

According to the note, in China, the worldwide share of Bitcoin transactions has declined swiftly from more than 90% to 10%.

China’s cryptocurrency narrative appears to be hastening again, just as Ukraine sparked significant interest in crypto adoption by declaring an airdrop for contributions, a first for a country. It had to be canceled after it was discovered that a third party was spoofing the much-awaited event.

According to Ukraine’s minister of digital transformation – Mykhailo Fedorov, Ukraine will soon be announcing NFTs (non-fungible tokens) for supporting Ukrainian Armed Forces.

The world’s largest democracy, India, may clarify its tax policy by changing the interpretation of cryptocurrency or virtual digital assets. According to CNBC TV-18, the Indian government is likely to change the definition for clarifying that virtual digital assets include only cryptocurrencies, crypto tokens, NFTs, and vouchers, but not other categories like Demat shares, credit card points, frequent flier points, e-vouchers, cash bank points, and so on.

According to the report, the government will also be including an elaborate FAQ for explaining the definition.

While the world’s attention is focused on the Federal Reserve of the United States and its plans to battle inflation, the debate over how inflation will impact cryptocurrencies continues.

According to CNBC, Bill Gross, the “bond king” the co-founder of Pacific Investment Management Co. (PIMCO), said he sees the potential of stagflation and would not purchase stocks aggressively now.

However, Kathy Bostjancic, chief US economist at Oxford Economics, informed CNBC that they were not yet in stagflation.

Stagflation occurs when stagnant economic growth, high inflation, and high unemployment all occur at the same time.

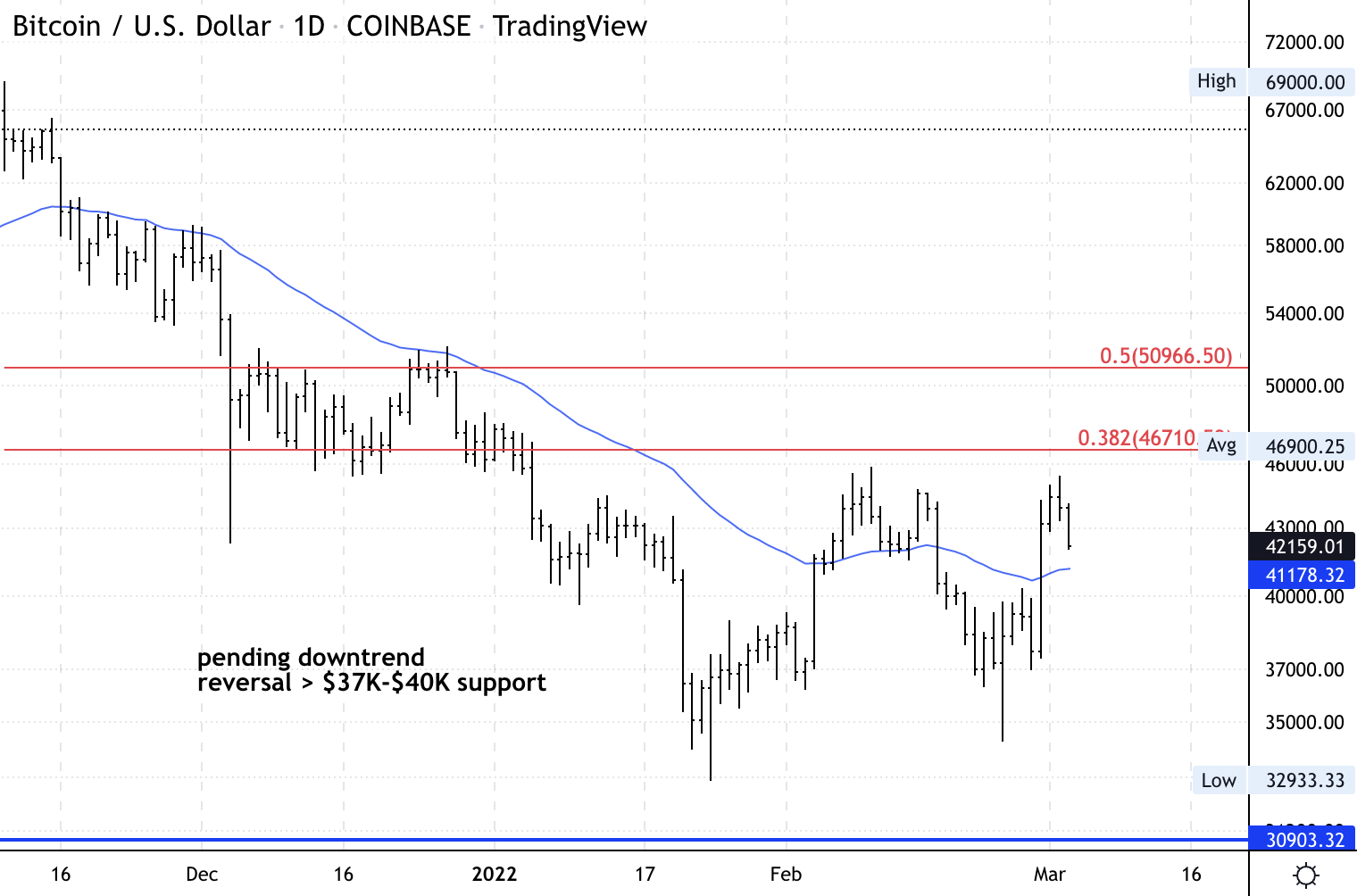

Technician’s viewpoint

Bitcoin Takes a Break; Support at $37,000-$40,000

Bitcoin extended its retreat from the $45,000 resistance level on Thursday, though initial support at $40,000 could help to stabilize the down move.

Buyers are required to keep BTC beyond the $37,000 breakout level for the recovery to continue. Furthermore, if momentum builds, a final move beyond $46,000 could result in additional upside targets near $50,000.

Intraday charts show early indications of downside exhaustion, which may motivate interim buying into the Asian trading day.

Fedorov, Ukraine’s digital minister, declared the annulment of an airdrop to crypto donors through his Twitter account, reversing plans. The hosts of “First Mover” spoke with Salman Banaei of Chainalysis about tracking crypto transactions during the Russia-Ukraine war and how to prevent crypto from being used to evade sanctions. The Market’s Compass technical analyst Timothy Brackett offered his crypto market analysis.