It’s a predictable uppercut, but it has significant weight since it comes from a significant voice, and it will undoubtedly damage the Crypto sector.

Additionally, the timing is bad for the market as cryptocurrencies have been growing strongly for a few weeks.

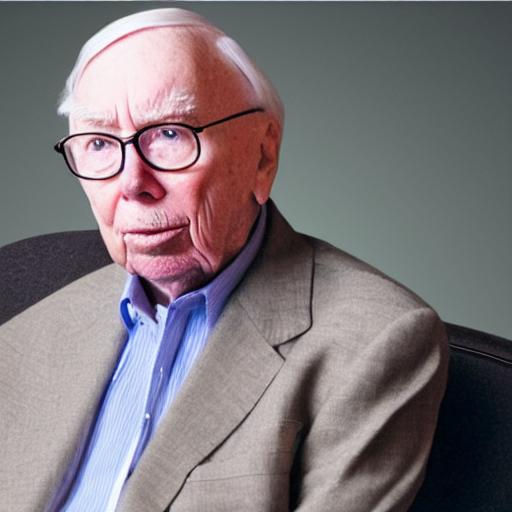

The 99-year-old billionaire Charlie Munger has once again criticized cryptocurrencies, saying they serve no useful purpose. Instead, he urges the United States to just forbid them, as China has done.

Thousands of new cryptocurrencies, both large and small, have been released by privately held businesses in the U.S. in recent years “Munger stated in an editorial that “Later, without any prior government permission of disclosures, these were traded publicly.

The renowned investor criticizes the fact that in some situations, a large block of cryptocurrency has been sold to a promoter for practically nothing, after which the public buys in at considerably higher prices without fully understanding the pre-dilution in favor of the promoter.

It’s “wild and woolly capitalism,” he says. He also references a quote attributed to Mark Twain, which reads, “A mine is a hole in the ground with a liar on top.”

Cryptocurrency Is “a Gambling Contract,” Says Munger

Then, he strikes cryptocurrency with a lethal punch as vice chairman of Berkshire Hathaway, the holding corporation he co-leads with Chief Executive Warren Buffett.

He claims that a cryptocurrency “is not a money, a good, or a security.” Instead, it’s a gambling agreement that gives the house a nearly 100% edge, made in a nation where governments that compete in laxness are typically the only ones to regulate gambling agreements.

What should we do as a result? The radical response from Munger is that the United States should now create a new legislature that stops this from happening.

He suggests that the American authorities employ “Two interesting examples” to accomplish this.

The first example included China’s communist government, which sensibly decided that cryptocurrencies would bring more harm than good and recently outlawed them.

And in the second example, which dates back to the early 1700s, England responded to a terrible slump that followed the failure of a promotional scheme to make enormous profits by trading with extremely poor people halfway around the world while utilizing slow-moving sailing ships.

“What the English Parliament did in its misery when this crazy campaign blew up was plain and simple: It prohibited all public trading in new common stocks and maintained this prohibition for almost 100 years,” he concluded.

Given that the White House and Congress are occupied with creating regulations for the industry following the overnight collapse of the FTX cryptocurrency exchange, Munger seems to imply that there is no other option. In February 2022, it was valued at $32 billion, and a few months later, it collapsed.

What should the United States do once a cryptocurrency prohibition is in effect? The billionaire continued, Well, one more thing would make sense: thank the Chinese communist leader for his excellent example of uncommon sense.

Bitcoin “Is Stupid”

Despite receiving a lot of attention, the famed investor’s op-ed did not stop the climb in cryptocurrency prices.

The most well-known cryptocurrency, Bitcoin, increased by 4.3% to $24,062.63 over the previous day.

Buffett and Munger are adamantly opposed to cryptocurrencies. At Berkshire Hathaway’s annual shareholder meeting last year, they destroyed bitcoin and cryptocurrencies.

At the time, Munger remarked, “I tend to avoid things that are dumb, evil, and make me seem terrible, and bitcoin does all three. It is dumb and might result in zero.”

Buffett, 92, was unapologetic in his remarks.

If you told me you had every bitcoin in existence and offered to sell it to me for $25, I wouldn’t accept it because I wouldn’t know what to do with it. It will act in any way, the Oracle of Omaha declared angrily. “Why should I acquire some bitcoin if I’m going to try to get rid of it?”

He once remarked that “perhaps rat poison squared” was the first cryptocurrency ever created.

“I don’t know if it will go up and down in the upcoming year, five years, or ten years. Buffett stated in April of last year, “But the one thing I’m fairly certain of is that it doesn’t generate anything. It has a magic to it, and people have associated magic with many different things.