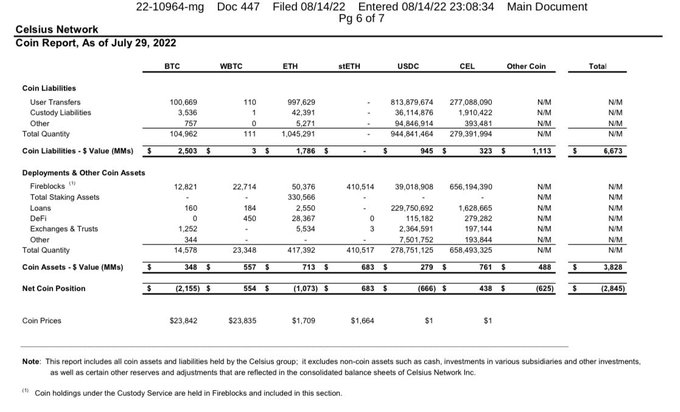

According to a new bankruptcy coin report filed on Sunday, troubled crypto lender Celsius’ actual debt is $2.85 billion, as opposed to their bankruptcy filing claims of a $1.2 billion deficit.

According to the most recent report, the company has net liabilities of $6.6 billion and total assets under management of $3.8 billion. In its bankruptcy filing, the company listed $4.3 billion in assets against $5.5 billion in liabilities, representing a $1.2 billion deficit.

According to the coin report, of the total 100,669 Bitcoin (BTC) deposited by investors, the company has lost 62,853 BTC and now holds only 37,926 BTC. Wrapped Bitcoin (WBTC) now accounts for 64% of the company’s BTC debt.

On July 14, the company filed for Chapter 11 bankruptcy, becoming one of many crypto lenders to fail as a result of the crypto contagion caused by the now-defunct Terra-USD collapse, which was exacerbated further following the crypto market collapse.

Simon Dixon, a crypto entrepreneur with a keen interest in the Celsius case, took to Twitter to highlight the new findings, claiming that the crypto lender’s actual balance gap is $3 billion versus their claims of $1.2 billion. People were upset, he said, when he showed the gaps and how Celsius was misleading and “making up numbers.”

While many cryptocurrency experts are critical of Celsius’s plans, the community has rallied behind the crypto lender in the hopes of recovering some of their funds. Because of a community-driven short squeeze, the price of the native token has risen several times since the bankruptcy. However, the latest findings appear to have dissuaded many existing account holders who are skeptical of receiving their funds back.

Source link