Every day we see a different traditional financial institution struggling to figure out its crypto strategy and it is clear why crypto has passed the tipping point of general awareness and use cases like cross-border payments are firmly off the scene.

Cross-border payments are one of the first crypto use cases for obvious reasons. In terms of quality, public blockchains and their native cryptocurrencies are global in nature and designed to be secure, censorship-resistant, inexpensive (depending on the token) and (possibly most). most importantly) you can instantly process transactions 24/7/365.

However, it took a few years for cryptocurrencies to make a noticeable dent in this $ 130 trillion industry where incumbents like money transfer companies and large banks had a monopoly. For example, the vast majority of Western Union’s revenue comes from individual transaction fees for cross-border payments.

It all comes down to cryptocurrencies having the same or better global liquidity than fiat and readily available entry ramps. Good news: both lines are doing well.

Antiquated systems favor big banks

The world of traditional currencies (FX) has been standing still for years: payments can only be made during normal banking hours, and although messages are sent via SWIFT, payments are only processed a few days later.

There are at least two different steps to this outdated correspondent banking system, and as we all painfully know, transactions are slow, error-prone, costly, and inefficient. Cost to consumers.

As you move into non G-20 currencies, no one can predict when your money will arrive from one country to another, and you’ll pay fees between 5% and 10%. they monopolized one another’s access to liquidity and accumulated trillions of dollars over the years.

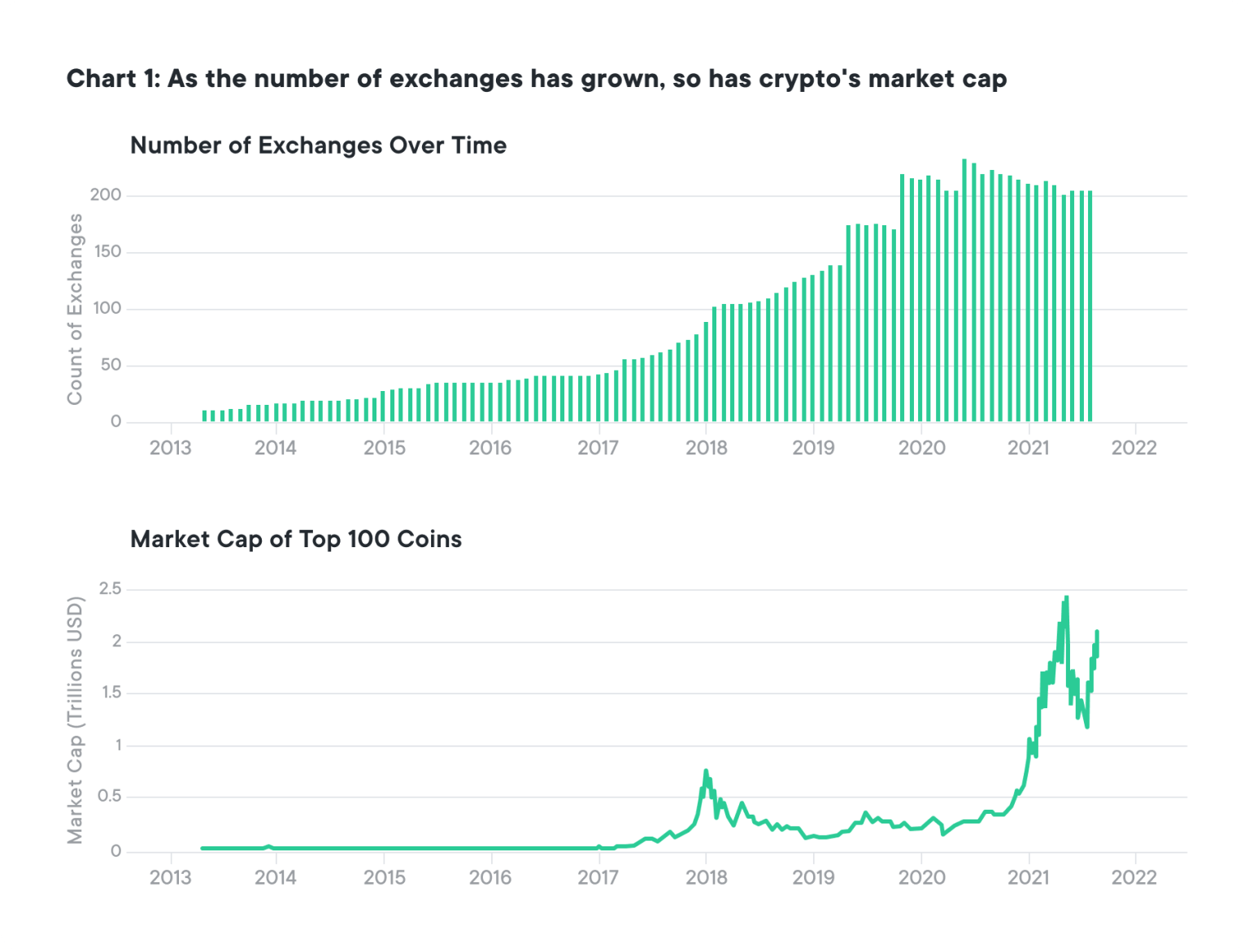

For years (prior to 2017), cryptocurrency liquidity was limited to a handful of a few million dollar exchanges across all assets, which has changed dramatically in recent years.

Ripple initially focused on the thesis that it will be cheaper to raise liquidity for cross-border payments with crypto compared to traditional fiat if (1) crypto grows in volume worldwide (measured by the liquidity level on exchanges) and (2) you can make larger payments (based on the size of the order book). What was a noble vision in 2015 is a reality today.

On- and off-ramps are required to access crypto liquidity

A key factor required to use crypto for cross-border payments is the ease of entry and exit ramps to move from fiat to crypto and vice versa for access to crypto liquidity. As stablecoins and exchanges, entry and exit in cryptocurrencies is growing rapidly. Everyone from large money transfer companies and card networks to global crypto exchanges is using tokenization to overcome this first hurdle.

Fiat-backed stablecoins have become one of the most popular entry and exit ramps, as they provide relatively easy access to cryptocurrencies without having to convert money to fiat money immediately when making a payment and thus the headache of exchange taxes and. eliminate high volatility in crypto.

This can be seen in the growing stablecoins market cap, which rose from $ 4 billion in 2019 to over $ 100 billion in July 2021 (crypto, identity, loans, NFT, etc.) the more liquidity there is in System in place to support the movement from one asset to the next.

Getting into the data

Now for the quantitative ratios: The data shows that raising liquidity from cryptocurrencies becomes more profitable than fiat over time. The fundamental question is at what data point does sourcing from crypto become consistently cheaper than traditional fiat foreign exchange (FX)?

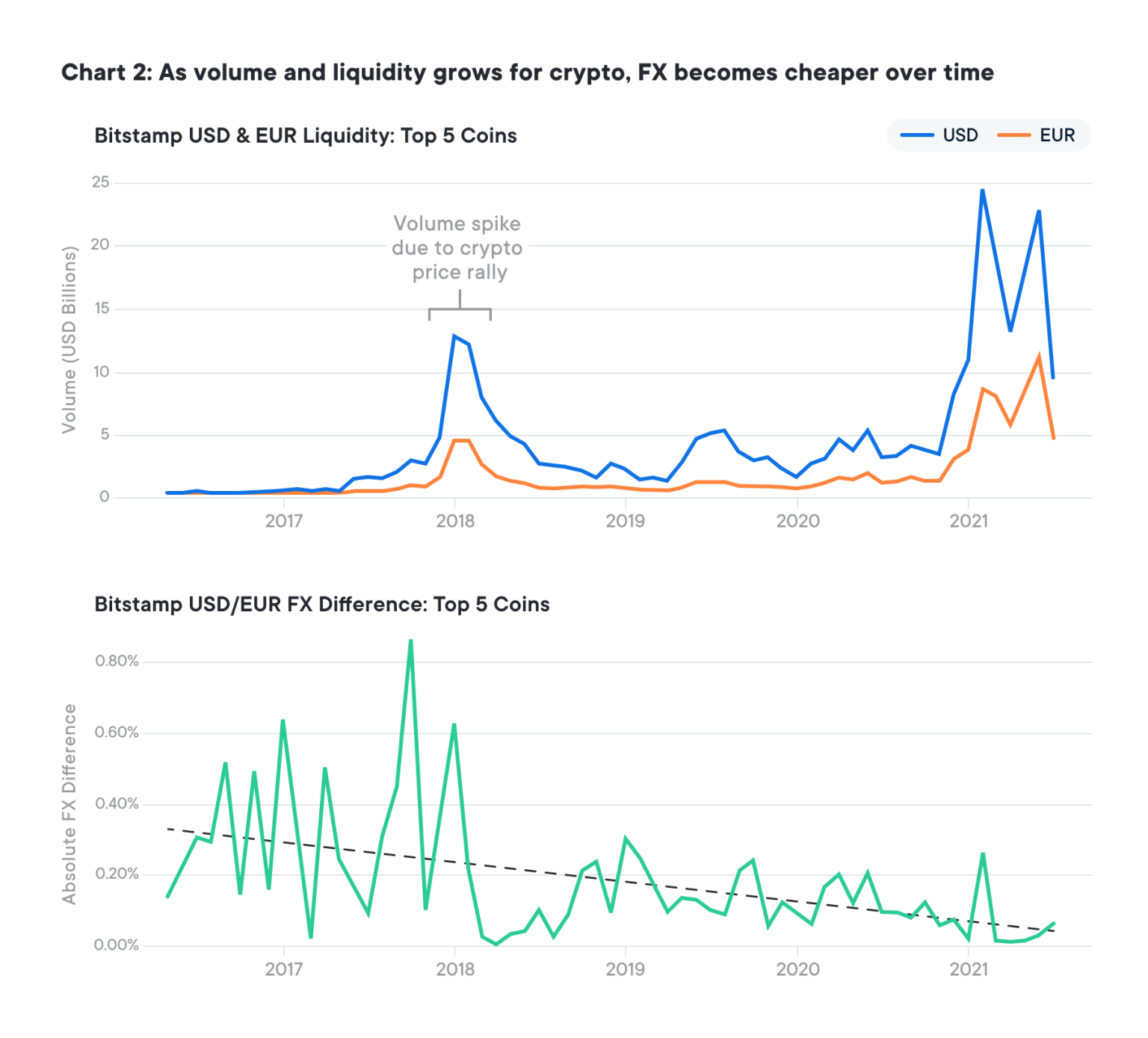

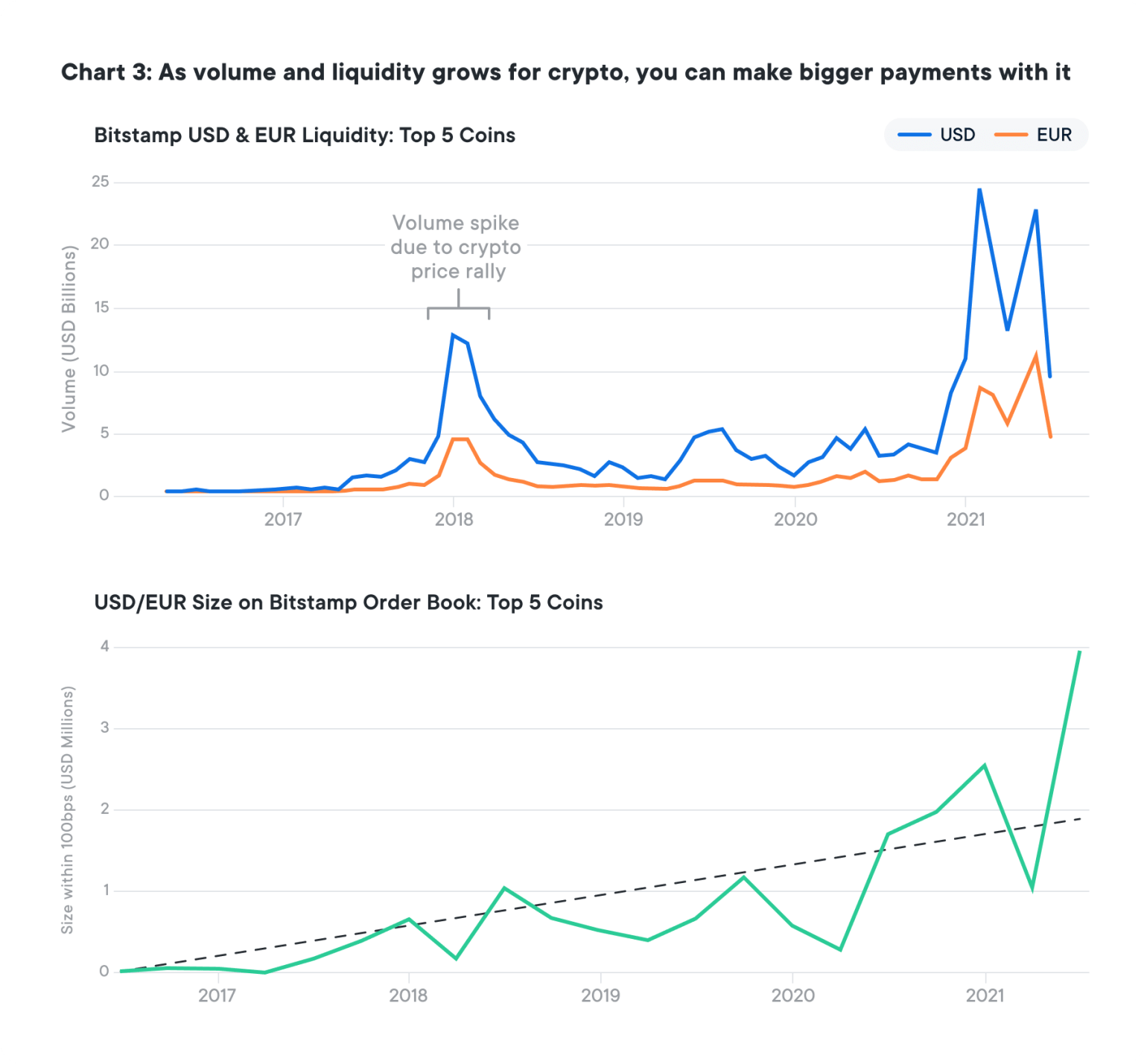

Using the graph below, we can see how the volume of cryptocurrencies, an indicator of liquidity, has grown over the past five years by comparing five of the major cryptocurrencies by market capitalization (Bitcoin, Ether, XRP, Litecoin and Bitcoin Cash) on Bitstamp use as a proxy for the largest crypto market. From 2016 to 2021, these assets consistently accounted for around 85% of total crypto volume (outside of stablecoins).

We specifically looked at the monthly volume in USD and EUR for all five tokens compared to the average USD difference and EUR in spot and implied exchange rates as well as the size of the order book in USD and EUR from April 2016 to June 2021.The spot rate shows the current exchange rate at that particular point in time, while the implied rate indicating the exchange rate reaches the exchange rate by creating a bridge between the sending currency and the target currency with an intermediary (e.g. by using a crypto-asset as a bridge).

Over the years, the difference between the spot rate and the implied rate approaches zero, which can be seen on the average trendline, which means that it is becoming smoother or cheaper to send payments via crypto than via fiat.

By further extrapolating the trendline, we could predict that the trendline will go from zero to a negative difference within the next two years (as long as the crypto volume continues to double at the current rate). Other factors are also worth mentioning. to win here, as payment providers such as PayPal or Western Union charge a fiat transaction fee (between 0.2% and 1% margin).

Over the same period, the graph above shows how the order book is growing rapidly in size, meaning that there is enough liquidity to support payments of up to $ 4 million in total with these five cryptocurrencies in 2021.

Traditional transaction-based payments revenue will become obsolete

All money transfer companies that generate a large portion of their income from foreign exchange transaction fees should sound alarms when viewing this data.

This is why companies are pushing to use crypto for cross-border payments: it’s no longer just about the qualities of blockchain and crypto that make it useful for this use case, but that global liquidity can really support these mass payments. With more options available to consumers, traditional businesses will have to cut transaction fees to maintain their market share, which will partially alleviate the problems.

To all consumers who have so far used PayPal or the like for cross-border payments: Why stick with it when it is cheaper, faster and safer, if not more, to use crypto?

These companies need to change their revenue models, which are currently heavily reliant on transaction fees, or risk becoming obsolete while some go in the opposite direction (i.e., PayPal has already upped its transaction fees for cross-border merchant payments in Europe, and Western Union is pushing even harder for digital payments to avoid competitors), the proverbial wave is already breaking off, and other services (compliance, addressing etc.) will not save them either – many crypto companies are already implementing robust anti-money-laundering and are familiar with their customer programs ( AML / KYC).

While this data, using BTC, ETH, XRP, LTC, and BCH in some corridors, is a proxy for the entire market, the trend lines in that direction are obvious, it’s $ 5 trillion or $ 10 trillion.

While this data, using BTC, ETH, XRP, LTC, and BCH in some corridors, is a proxy for the entire market, the trend lines in that direction are obvious, it’s $ 5 trillion or $ 10 trillion.