One concerning measure, according to a well-known cryptocurrency analyst, indicates that the current surge in Bitcoin (BTC) may not be sustainable.

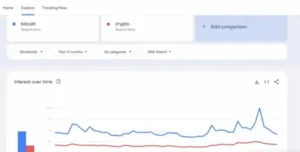

Crypto strategist Jason Pizzino informs his 310,000 YouTube followers in a recent video update that there may be a decline in the public’s interest in the flagship digital asset, as indicated by a decline in Google searches for the phrase “Bitcoin.”

Pizzino claims that there has been a significant correlation between Bitcoin’s price fluctuations and its Google search results.

This graphic is now the most troubling piece of the puzzle for Bitcoin and cryptocurrency. There was a lot of interest through the ETF (exchange-traded fund); the date, [the] 7th to the 13th of January – Bitcoin has a reading of 100 on Google.

We often observe a correlation between what individuals are looking for and when prices peak or bottom. So far, the highest price has been $49,000. Since then, interest in the Bitcoin search phrase has decreased week after week, despite the fact that the price has increased.

Could this time be entirely different? We’ll see, but most of the time you’ll notice peaks – interest surges over time with specific critical events.

Pizzino continues, stating that a spike in volume is necessary for Bitcoin to surpass the $49,000 mark, and that this must occur within the next week or two.

However, the volume is really lacking for the subsequent upward swing it made. Well, anything can happen in this situation; after all, we’re just investigators trying to discover out what goes on. For the bull run, we would require a break over $49,000 and a hold there fairly quickly, By the end of this week or the next, hopefully.

As of this writing, the price of bitcoin is $48,086.