Summary

- The speculative fervor in markets has catalyzed the recent spike in Bitcoin and Ethereum.

- Bitcoin is now the most crowded trade. That label was a bad sign in late 2017.

- Bitcoin is not a reflation trade. It’s a risk on trade.

- Ethereum and Bitcoin prices are joined at the hip regardless of their fundamental differences.

Thesis

I think Bitcoin (BTC-USD) and Ethereum (ETH-USD) are rising due to excess speculation and will crash soon when sentiment turns. Cryptocurrencies are like a leveraged version of the triple leveraged Nasdaq 100 (TQQQ) providing the highest beta imaginable. There is a core cult-like group of believers who think bitcoin and Ethereum are valuable, so they will never go to zero. However, when the momentum shifts and the gamblers leave, they will fall dramatically just like in 2018.

There was euphoria in stocks and cryptos late in 2017, but now we are seeing much more retail participation. There was a lot of optimism even 6 months ago, but now the worst stocks (penny stocks) are leading the way instead of FAAMNG. This is a sign we are in the final stages of the bubble. Investors in money losing hype stocks and cryptocurrencies will have nothing to hold onto when the momentum shifts. They don’t pay dividends or buy back shares which limit declines in the stocks of profitable businesses.

Excess Speculation Has Become The Norm

There is no hope for sane fund managers. The last remaining managers who love to short companies with poor fundamentals have done horribly in the past few months. For example, Bronte Capital had 5 losing months in a row to end 2020. Their prior longest losing streak was 3 months (started in March 2012). The fund had outperformed markedly from inception until near the end of last year. In their letter, they say, “However, perhaps you possibly know a young manager who has earned well over 100 percent this year. You might want to take your money there. It pains us to say this – but given our results we will understand if you do.” New investors are beating the pros as crypto and money losing stocks have exploded. Bronte is being forced to pull back on its shorts because they haven’t worked.

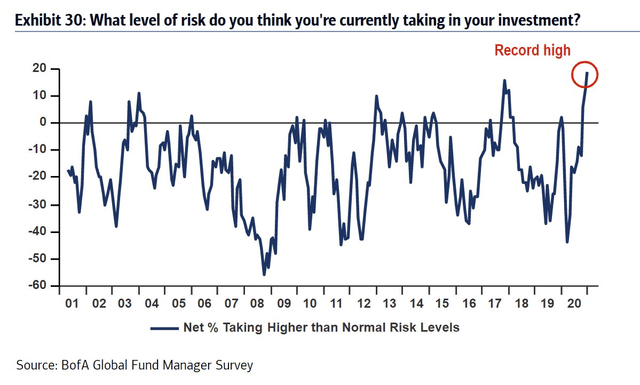

As an individual investor, I can wait out this bubble for many quarters in value stocks or cash, but fund managers can’t afford to underperform for long because their investors will flee. As you can see from the chart above, they are being forced to take excess risk. A record net 19% of fund managers are taking higher than normal risks according to the Bank of America survey in January. That’s up 6 points from last month. Bank of America’s clients have $561 billion in assets. Clients are the most optimistic on corporate profits since 2002. I actually agree with them because of the fiscal stimuli and the reopening of the economy, but high sentiment is worrisome.

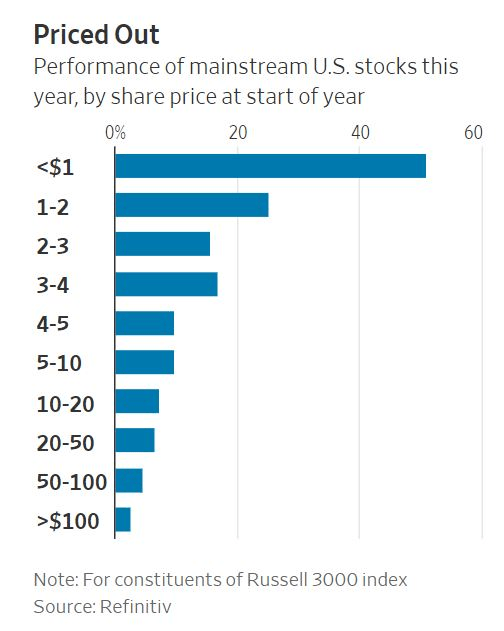

Of course, retail traders are following along for the ride. As I mentioned, the stocks with the worst fundamentals are now doing the best as retail starts to shirk the tried-and-true FAAMNG names. Tesla and Nio are the 1st and 3rd most popular stocks on Robinhood (Apple is 2nd). As you can see from the chart below, the lower the stock price, the better it has done this year. Stocks below $1 have already risen about 50% this year. Remember, this is following the 1 trillion shares of penny stocks that were traded in December.

Some Justification For Crypto

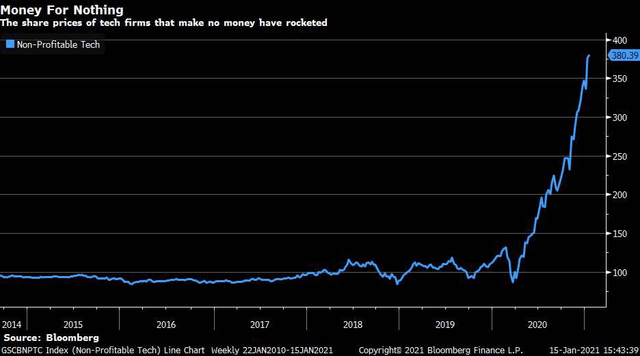

For the past few years, the trend of valuation not being important if the fundamentals are sound has been gaining steam partially due to low rates. That has helped drive stocks like MSCI and Rollins to extremely elevated levels. MSCI (MSCI) and Rollins (ROL) trade at 48 times and 72 times 2021 earnings estimates. I love those companies, but they are too expensive. That mantra that valuation isn’t important has morphed into not caring about profits at all.

If speculators don’t care about profits, I can see why they would trade cryptocurrencies which also have no cash flows or real value. As you can see from the chart above, non-profitable tech stocks have gone vertical. Many of these firms are software stocks that benefit from the work from home trade. I wonder how long that will last since the economy is on the brink of reopening. Some are online retailers who also benefited from the shutdowns.

Retail traders were stuck at home and had stimulus money to play with. This is also benefiting Bitcoin and Ethereum. The next stimulus might give $1,400 checks, but people might not be stuck at home when they get the money as hospitalization in America have peaked and 4.7% of the country has been vaccinated. Maybe that money won’t go into speculative financial assets.

Keep Your Wits About You

It’s important as an individual investor to avoid FOMO. It was tough for value investors in August when the tech stocks were vastly outperforming the banks and energy, but it has gotten easier since the vaccines have come out. Great traders have persistence, manage their risk, pick their spots, and stay sane.

Personally, I won’t be putting any of my capital in Bitcoin or Ethereum regardless of how much they go up. I know some investors are thinking if they had put a few percentage points of their net worth in these coins, they would have done very well, but just ignore the hype. There will always be something doing better than your portfolio in the short term. The goal is long term returns, not tripling your money in a year. That usually comes with high risk.

Everyone Knows Bitcoin Is A Bubble

Coming out of the 2008 financial crisis, there was a lot of allure surrounding the investors who called the housing bubble in the 2000s. I personally only started following stocks in 2007 as a teenager, so I didn’t experience what it was like from 2003 to 2007 in the housing market. However, generally speaking I’ve read bubbles are easy to spot. Don’t overthink this. The fact that most investors surveyed by Deutsche Bank see bubbles in financial markets doesn’t mean you should go contrarian on this survey and buy into them. In fact, the real contrarian play is to avoid the bubbles and stay disciplined.

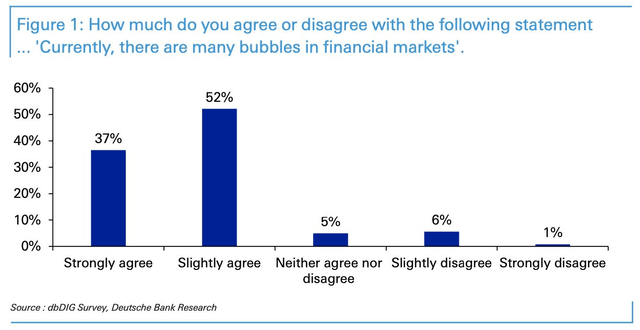

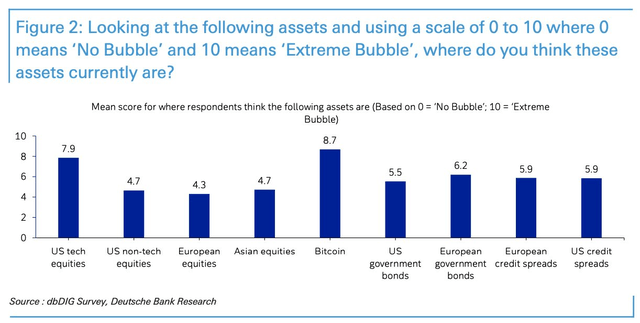

As you can see from the chart below, 89% of investors either strongly agree or slightly agree that there are bubbles in financial markets. Even though it’s widely known these are bubbles, many still invest in them because they think they can get out before the bust.

The fact that this question of whether there are bubbles is even being asked gives you a great understanding of the situation we are in. So where are the bubbles? The main bubbles are in U.S. tech stocks and bitcoin according to this survey. A reading of 10 is an extreme bubble; bitcoin was given an 8.7 (US tech is at 7.9). It doesn’t get much higher than that. Of course, if Ethereum was added as an option or if the option was cryptocurrencies, the same response would have been received.

In bubbles you see extreme action that is no different from gambling. We recently have seen that from the social trading website eToro (ETORO). This 13 year old company which has 17 million users, was reported to have opened 380,000 new accounts in 11 days (as of January 13th). Its crypto trading volume is running 25 times the amount it was at this time last year. Some said they only had that many new accounts because they were running a promotion were clients got $500 when they added $5,000. That only supports the bubble thesis as companies are trying to get traders hooked like gamblers and it’s working. That’s the exact type of promotion sports betting sites use.

Of course, eToro isn’t the only crypto trading app. There are also the big boys, PayPal (PYPL), Square (SQ), and Robinhood (RBNHD). Remember, crypto trading just started being rolled out on Robinhood as the bubble was bursting in 2018. It was done on a state-by-state basis, not all at once. Robinhood now has 13 million users where they all can trade Bitcoin and Ethereum. It even offers a few altcoins. This is a virtuous circle where traders demand crypto trading and trading apps promote it.

According to a study by Mizuho Securities, nearly 1/5th of PayPal’s users have traded bitcoin using the app. PayPal had 361 million active users as of Q3 2020. We know the CEO of Square, Jack Dorsey, is a massive fan of bitcoin. He even promoted it when discussing Twitter’s censorship which didn’t have much to do with the topic.

Long Bitcoin Is The Most Crowded Trade

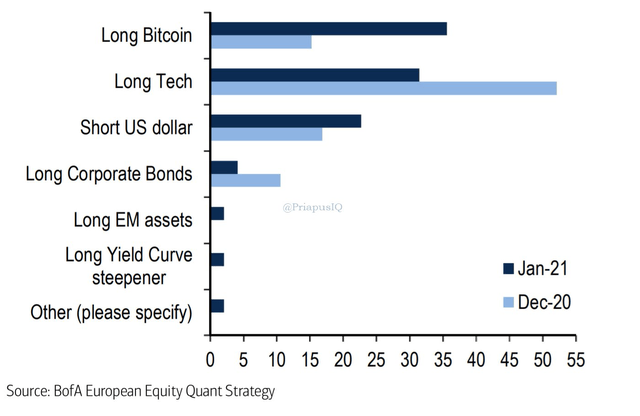

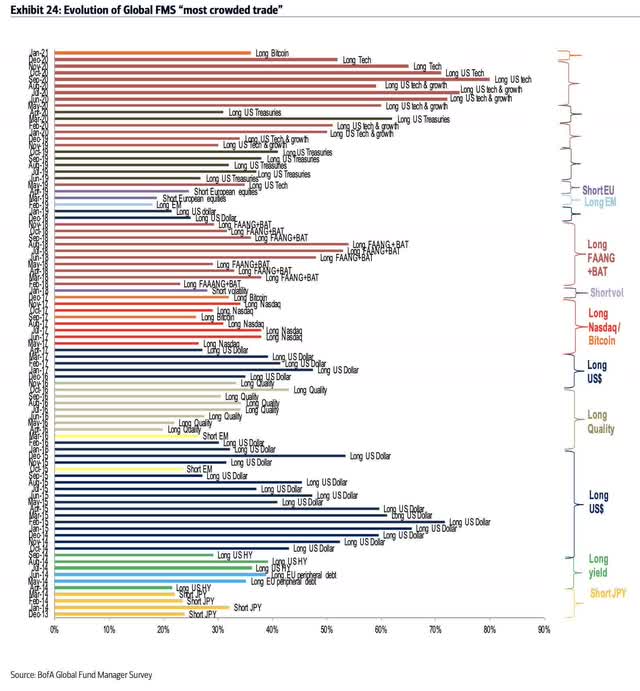

Bitcoin is back to being the most crowded trade in the Bank of America survey. As you can see from the chart below, responses of “long bitcoin” being named the most crowded trade more than doubled to 36%. I can see why some pulled back from calling tech crowded as the FAAMNG stocks have mostly cooled off in the past few weeks.

The chart below shows the history of this survey. Long tech had been the most crowded trade for most of last year, yet it didn’t lead to its demise. On the other hand, this was a great indicator that bitcoin was near its top in its last bubble in late 2017. As you can see, long bitcoin was the most crowded trade in September and December 2017 which was right at the top (in December 2017). I think this works as a good timing tool for bitcoin because bitcoin is largely ignored outside of when it spikes a lot. It’s not like tech stocks where most investors need to ask themselves everyday if the prices make sense. Because of this hyper analyzation, traders call froth before it fully develops.

Bitcoin Is Not A Reflation Trade

I think it’s more likely that low rates help bitcoin than inflation. Bitcoin is not a reflation trade even though some retail speculators buy it because of “money printing” in spite of the fact inflation has been low for years and rates have fallen. CPI was 2.1% in 2017 and 2.4% in 2018, meaning bitcoin did worse in a year with higher inflation.

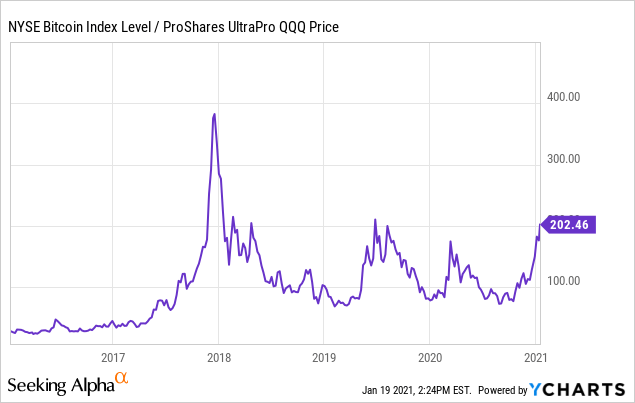

I think bitcoin is a speculative tool that provides higher beta than the TQQQ which is triple leveraged bet on the Nasdaq 100. Of course, the Nasdaq 100 does better with low rates because it is driven by large cap growth. The chart below shows the ratio of bitcoin to the TQQQ. As you can see, we aren’t near the peak in December 2017 partially because tech has exploded recently. It doesn’t mean bitcoin is less speculative now; it means large cap growth is more speculative.

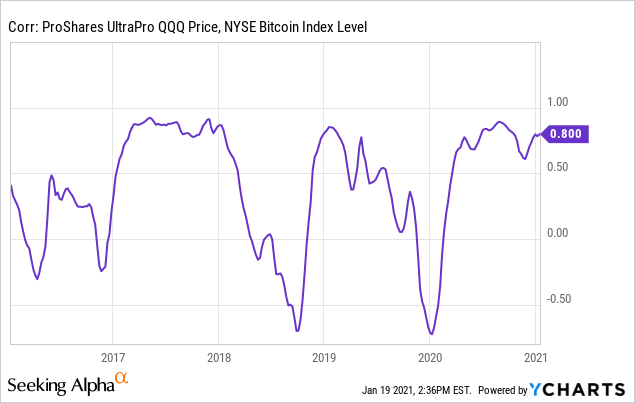

As you can see from the chart below, the correlation between the TQQQ and bitcoin has been extremely volatile. We’re near the peak correlation that we saw at the bitcoin peak in 2017. I thought it was interesting how cryptos crashed in December 2017 right before the short VIX trade unwind caused the stock market to correct. I think both the TQQQ and bitcoin will fall together when this high beta bonanza dries up. Bitcoin is a ‘risk on’ trade; it’s not a safe haven, a store of value, or an inflation hedge. The price of bitcoin crashed more than 50% in the March 2020 crash with the other risk assets while treasuries rose. The 10 year bond is the real safe haven trade in an uncertain environment (excluding inflationary events).

Lost Bitcoin

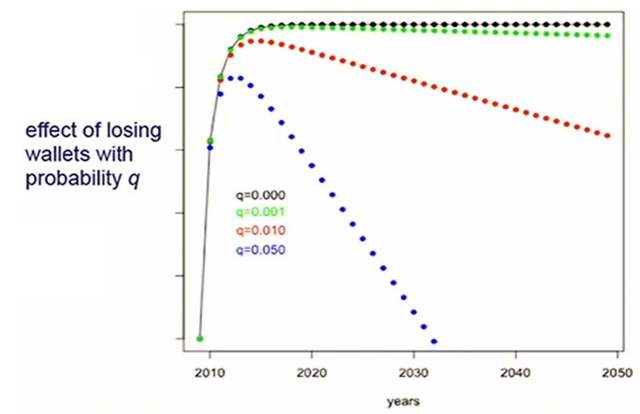

Bitcoin is the opposite of a store of value as it is a speculative instrument. If the definition of a store of value is expanded to anything that holds any worth, then every single asset is a store of value. It becomes a meaningless definition. Speaking of store of values, some have a difficult time storing bitcoin. When people lose their private keys, those bitcoins are essentially gone. The chart below shows various scenarios where wallets are lost and how they impact the amount of bitcoin outstanding. Someone losing bitcoin doesn’t stop the crypto because it can be divided by a limitless amount. However, this highlights the benefit of having a financial institution to protect you. It might not be fun to call the bank, but at least there is someone to call and your money is insured.

Ethereum Is Also A Bubble

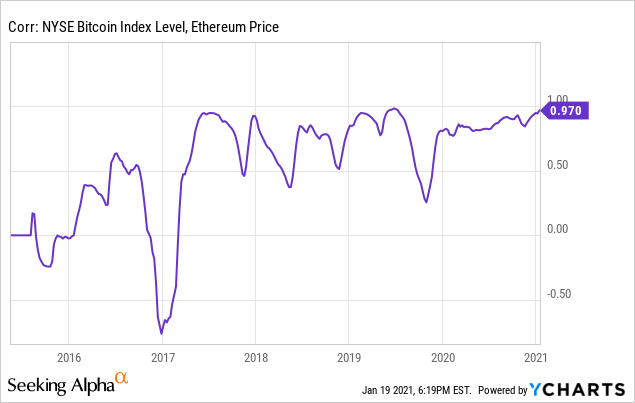

I treat cryptocurrencies the same except, the smaller the coin, the more volatile it is and the higher the chance it falls to zero. I think network effects and publicity help the top few coins. We’ve seen that with Dogecoin which was abandoned by its founder in 2015, yet has stuck around because of its funny name and logo. The technology difference of Ethereum and Bitcoin really doesn’t matter to the price because it’s driven by speculators. As you can see, their correlation is 0.97. When the bubble bursts, they will both fall.

My Position

I have zero cryptocurrencies. I’m operating with the framework that there are opportunities because of this bubble in crypto. You don’t need to short bubbles. In fact, you likely shouldn’t. The most conservative course of action is to buy the boring stocks abandoned by speculators. Altria (MO) is the anti-Tesla (TSLA). My portfolio is anti-hype which means it’s anti-crypto.

This article has been published from the source link without modifications to the text. Only the headline has been changed.

Source link